End of March quarter

Here we are at the end of another quarter (what, already?!)

its time to start preparing the BAS.

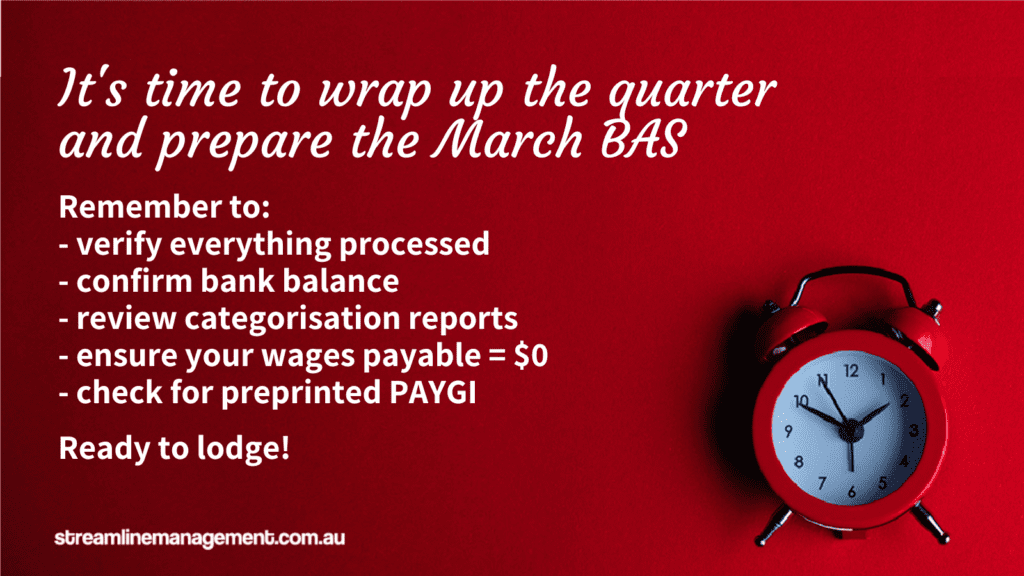

Remember to verify, check, corroborate, review, ensure, confirm, establish and substantiate all details before submitting to the ATO.

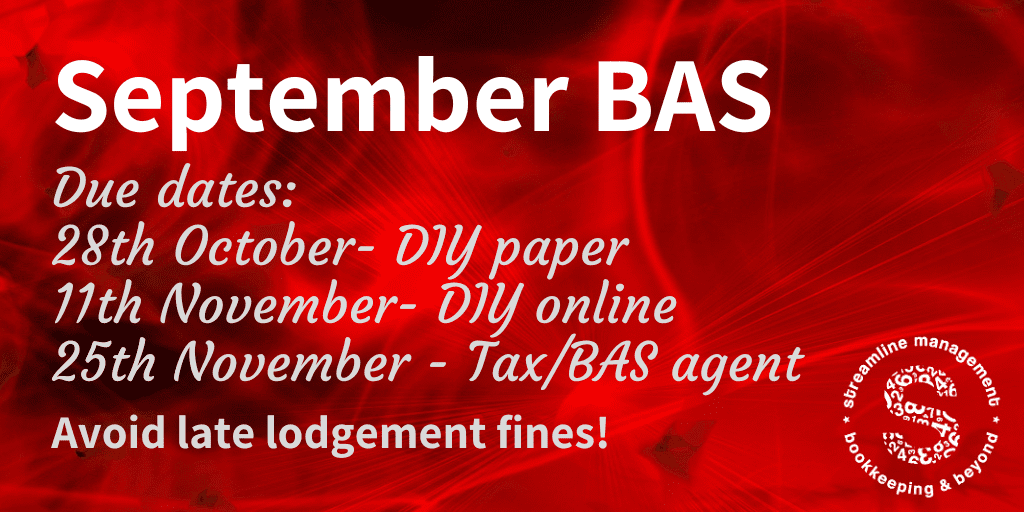

Not sure you’re the best person to do all the checks? Ask us if we could help you remain on the better side of the ATO. Only BAS agents can assist with BAS preparation and lodgement. If your bookkeeper is not registered they cannot provide you with ANY information that could be included in your ATO lodgement.