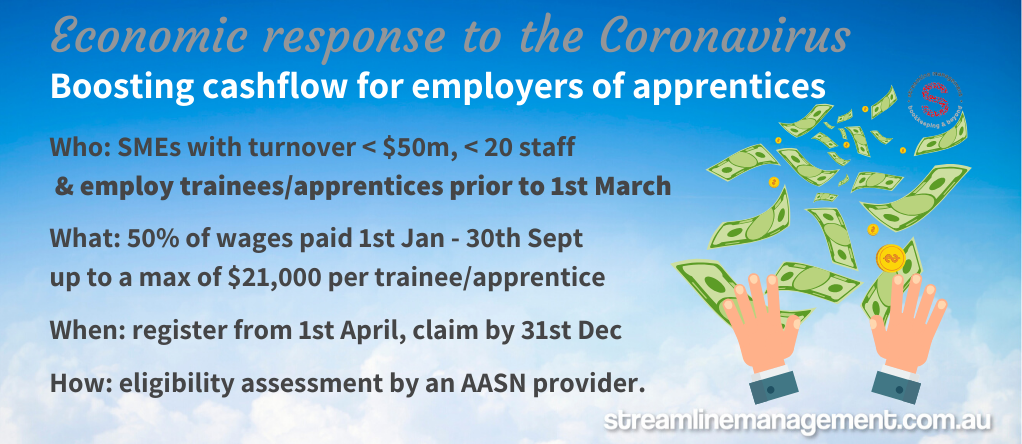

The Government is supporting small business to retain their apprentices and trainees. Eligible employers can apply for a wage subsidy of 50% of the apprentice’s or trainee’s wage paid during the 9 months from 1 January 2020 to 30 September 2020. Where a small business is not able to retain an apprentice, the subsidy will be available to a new employer.

Employers will be reimbursed up to a maximum of $21,000 per eligible apprentice or trainee ($7,000 per quarter).

The subsidy will be available to small businesses employing fewer than 20 full-time employees who retain an apprentice or trainee. The apprentice or trainee must have been in training with a small business as at 1 March 2020.

Employers can register for the subsidy from early April 2020. Final claims for payment must be lodged by 31 December 2020.

Further information is available at:

• The Department of Education, Skills and Employment website at: www.dese.gov.au

• Australian Apprenticeships website at: www.australianapprenticeships.gov.au

For further information on how to apply for the subsidy, including information on eligibility, contact an Australian Apprenticeship Support Network (AASN) provider.

Contact us or your BAS agent if you need any additional details.