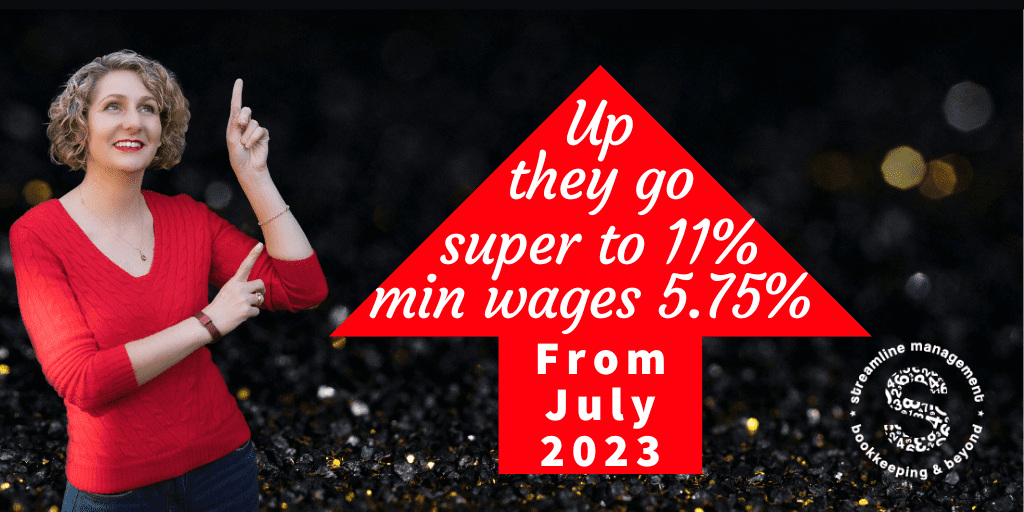

There are alot of changes taking effect from 1st July 2023, we’ve prepared an overview for you.

Super goes up on all wage payments made to staff on or after 1st July (regardless of work period). Some contractors will also be entitled to super at the new rate. This super must reach employee funds on or before 28th October. Super accrued on wages paid between April and June is at the old rate and must reach super funds on or before 28th July. There will be more increases until super reaches 12%. https://www.ato.gov.au/Rates/Key-superannuation-rates-and-thresholds/?=redirected_SuperRate&anchor=Superguaranteepercentage#Superguaranteepercentage

Minimum wages are rising. The National Minimum Wage applies to employees not covered by an award or registered agreement. $23.23 p/h or $882.80 p/w.

Award minimums are up by 5.75% from the first FULL pay period from 1st July. Check the rates for your employees here https://www.fairwork.gov.au/pay-and-wages/minimum-wages/pay-guides

Paid Parental Leave is changing too.

From 1 July 2023, partnered couples can claim up to 20 weeks’ paid parental leave between them. Parents who are single at the time of their claim can access the full 20 weeks. More info here: https://www.fairwork.gov.au/newsroom/news/changes-to-the-paid-parental-leave-scheme