Streamline Management News

* This is generic info to give you a few pointers and should never be relied on as specific accounting advice.

Contact your expert (not your mates at a BBQ or the guy trying to sell you something) to discuss your situation.

Anzac Day wages and long weekends

Anzac Day is on a Thursday this year, if you close your workplace, you need to pay your full time and part time staff for their normal Thursday work hours.

Staff may also request Friday as annual leave to take a long weekend – make sure you process leave requests to keep their balances up to date and report STP data to the ATO correctly.

Kicking off the work day early during the school holidays?

Are members of your team kicking the day off early to sneak out a bit earlier during the holidays?

Employers need to be aware what ordinary spread of hours of work are for their industry, and when extra loadings might be payable.

Check your award for fine print before your flexible work arrangements cost you more than you bargained for!

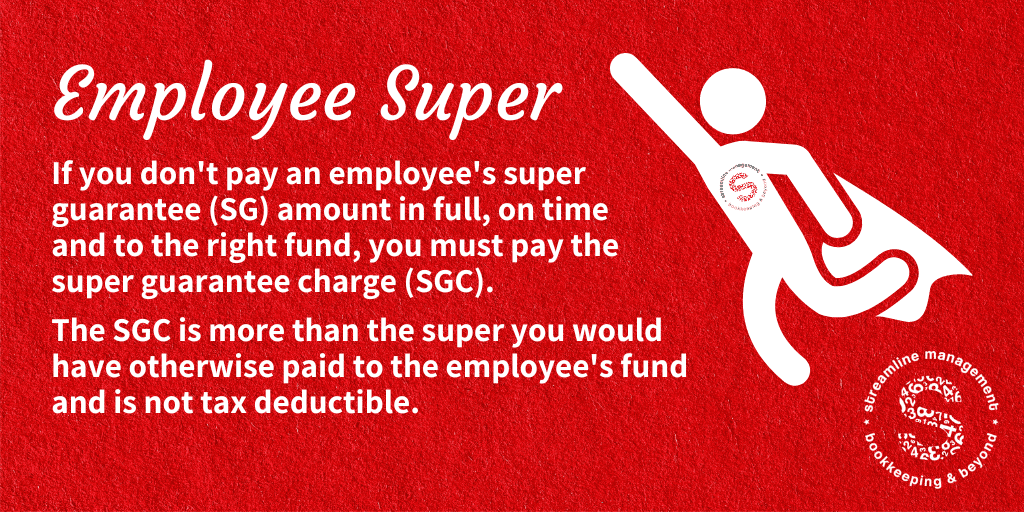

January – March 2024 super is due soon

March super contributions, must be received (by fund) by 28th April for employees (including working directors) and some sole trader contractors.

Severe penalties will apply for late payments

Afternoon Tea Month

Need to stop for a breather?

Why don’t we get together for afternoon tea and a chat?

(the chat doesn’t have to be all about bookkeeping – we love a good gossip!)

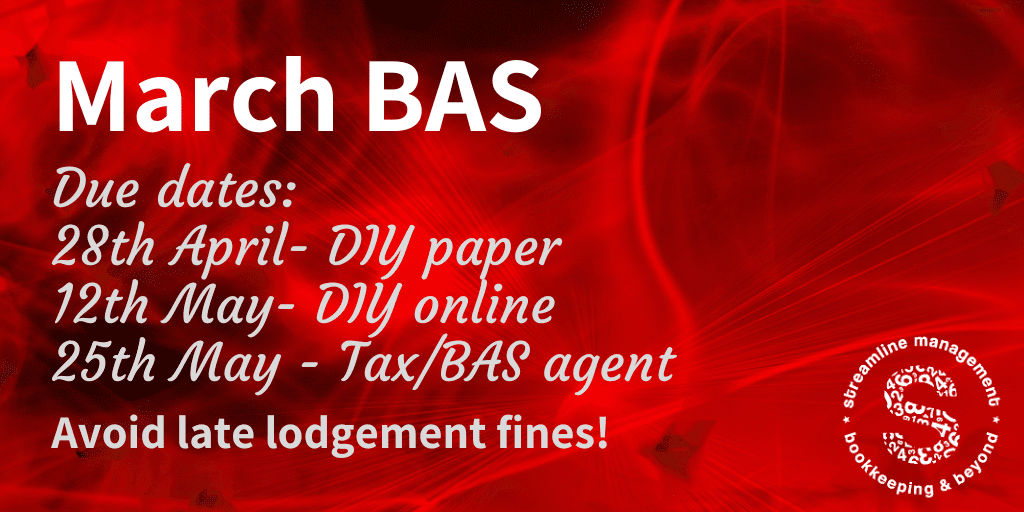

March 2024 quarter BAS is due soon

It’s time to start preparing your March BAS.

There are a few possible due dates – depending on your lodgement method. Late lodgement leave you open to fines and penalties, so act now!

If you are one of our clients, taking advantage of our extended deadline:

Make sure everything is uploaded to ReceiptBank / Dext so we can get to work. Please send bank statement PDFs.

Go for Broke Day

Go for Broke – not Go Broke!

No, we don’t mean organise a roadtrip to the Hunter Valley either!

You’re probably all in when it comes to your small business in order to succeed.

If you’ve accidentally missed out a word and it looks like you might be going broke – ask for help right away. Your accountant and bookkeeper can point you in the right direction if you haven’t gone past the point of no return.

Times are tough, its not failure to ask for help. Its a sensible business decision!

Cloud Security Day

Data security is important – use 2 Factor Authentication where possible and long unique passphrases.

Anti-virus software will also help keep the baddies out.

Not sure if you could be doing better? Take the cyber security quiz

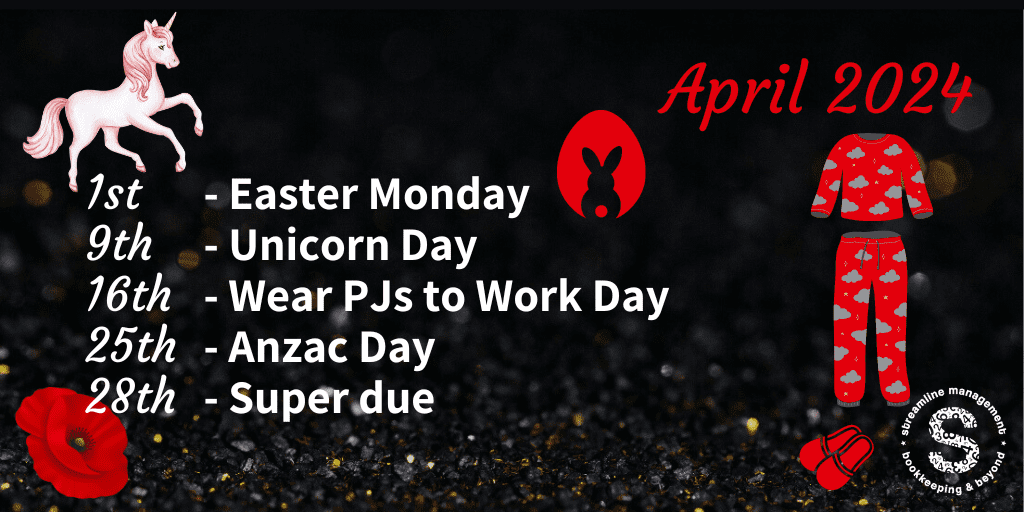

April 2024

April has started with a public holiday, so what else is happening this month?

2 public holidays this month will eat into your work time – claw a little time back by wearing your PJs to work!

Super for the January-March quarter needs to be in your employees fund by 28th April – approve super early, as the 28th is a Sunday and 25th is a public holiday.

Don’t forget to feed and exercise your unicorn!

Most small businesses will not have a tax office lodgement due this month – however, there could be 2 next month.

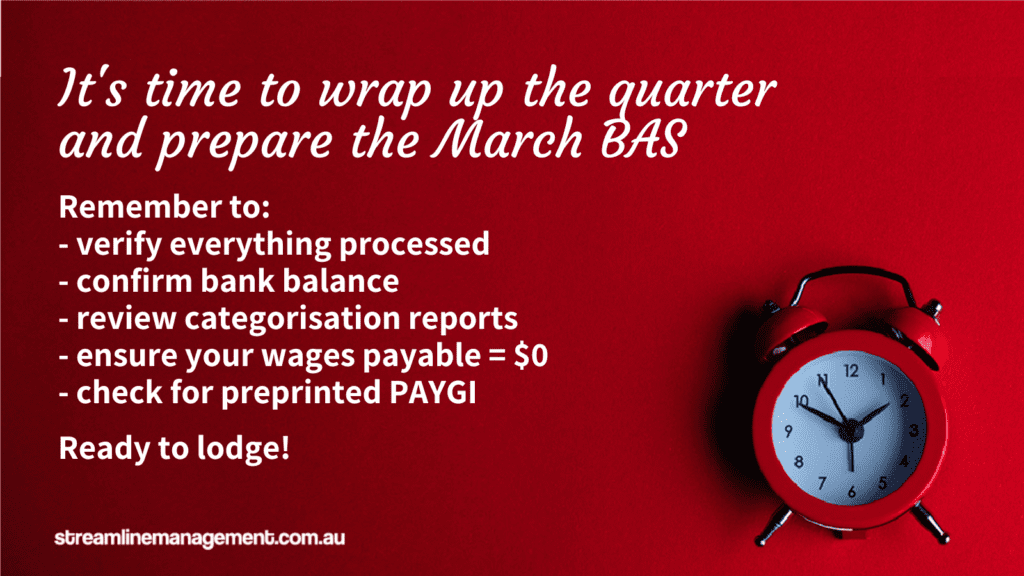

End of March quarter

Here we are at the end of another quarter (what, already?!)

its time to start preparing the BAS.

Remember to verify, check, corroborate, review, ensure, confirm, establish and substantiate all details before submitting to the ATO.

Not sure you’re the best person to do all the checks? Ask us if we could help you remain on the better side of the ATO. Only BAS agents can assist with BAS preparation and lodgement. If your bookkeeper is not registered they cannot provide you with ANY information that could be included in your ATO lodgement.

FOLLOW US

to keep up with the news

Subscribe to our Newsletter

Be the first to know about critical dates and important gossip!