January – March 2024 super is due soon

March super contributions, must be received (by fund) by 28th April for employees (including working directors) and some sole trader contractors.

Severe penalties will apply for late payments

March super contributions, must be received (by fund) by 28th April for employees (including working directors) and some sole trader contractors.

Severe penalties will apply for late payments

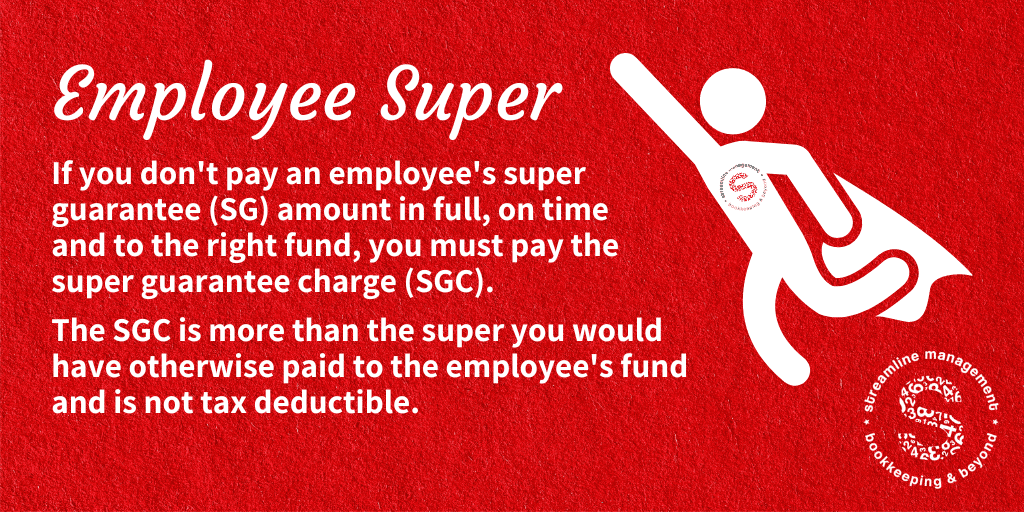

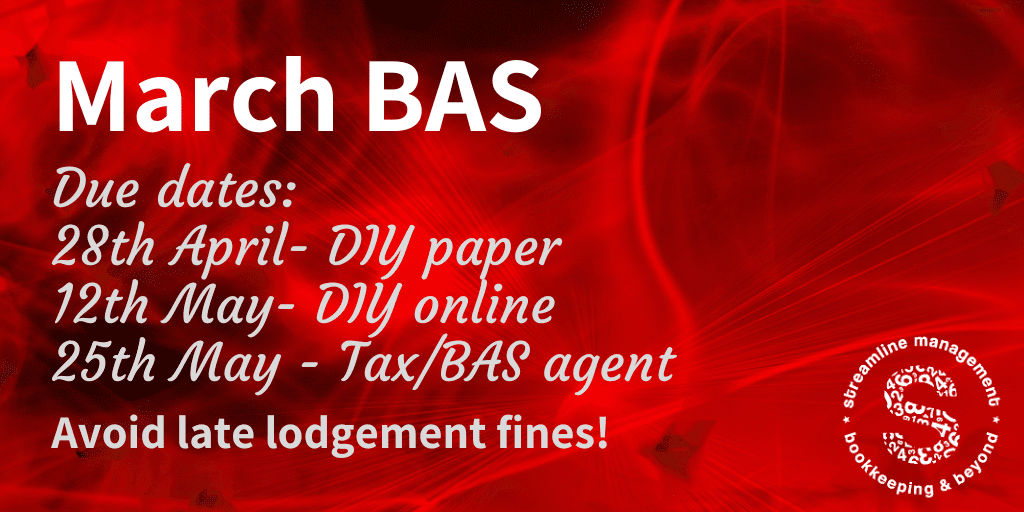

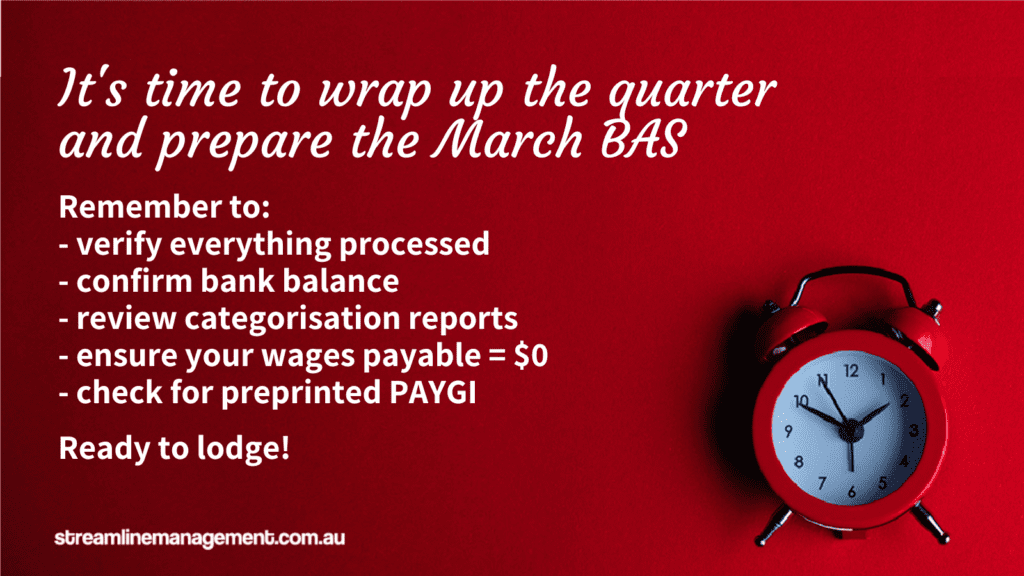

It’s time to start preparing your March BAS.

There are a few possible due dates – depending on your lodgement method. Late lodgement leave you open to fines and penalties, so act now!

If you are one of our clients, taking advantage of our extended deadline:

Make sure everything is uploaded to ReceiptBank / Dext so we can get to work. Please send bank statement PDFs.

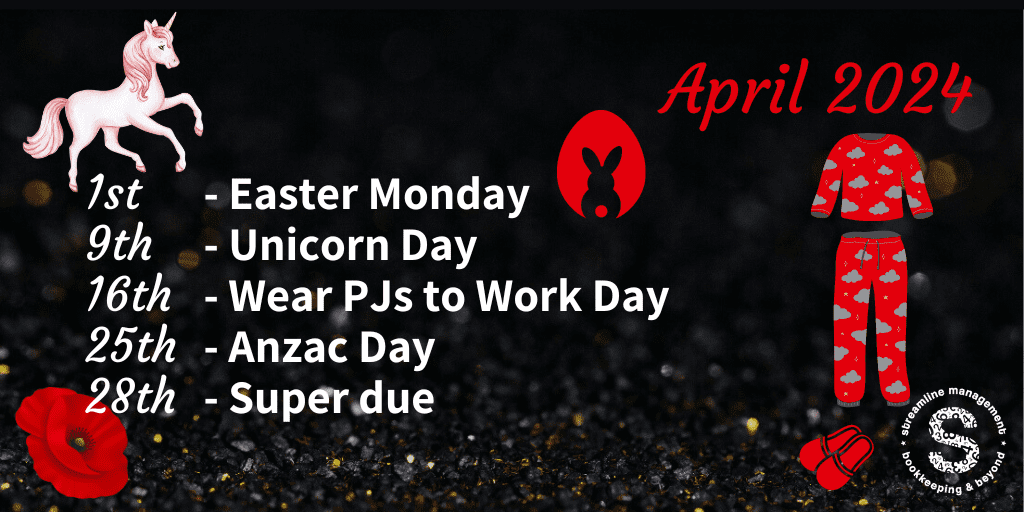

April has started with a public holiday, so what else is happening this month?

2 public holidays this month will eat into your work time – claw a little time back by wearing your PJs to work!

Super for the January-March quarter needs to be in your employees fund by 28th April – approve super early, as the 28th is a Sunday and 25th is a public holiday.

Don’t forget to feed and exercise your unicorn!

Most small businesses will not have a tax office lodgement due this month – however, there could be 2 next month.

Here we are at the end of another quarter (what, already?!)

its time to start preparing the BAS.

Remember to verify, check, corroborate, review, ensure, confirm, establish and substantiate all details before submitting to the ATO.

Not sure you’re the best person to do all the checks? Ask us if we could help you remain on the better side of the ATO. Only BAS agents can assist with BAS preparation and lodgement. If your bookkeeper is not registered they cannot provide you with ANY information that could be included in your ATO lodgement.

Don’t forget to make sure you’ve lodged and paid your February IAS.

If you are unable to pay in full, contact the ATO on 13 72 26 to arrange a payment plan.

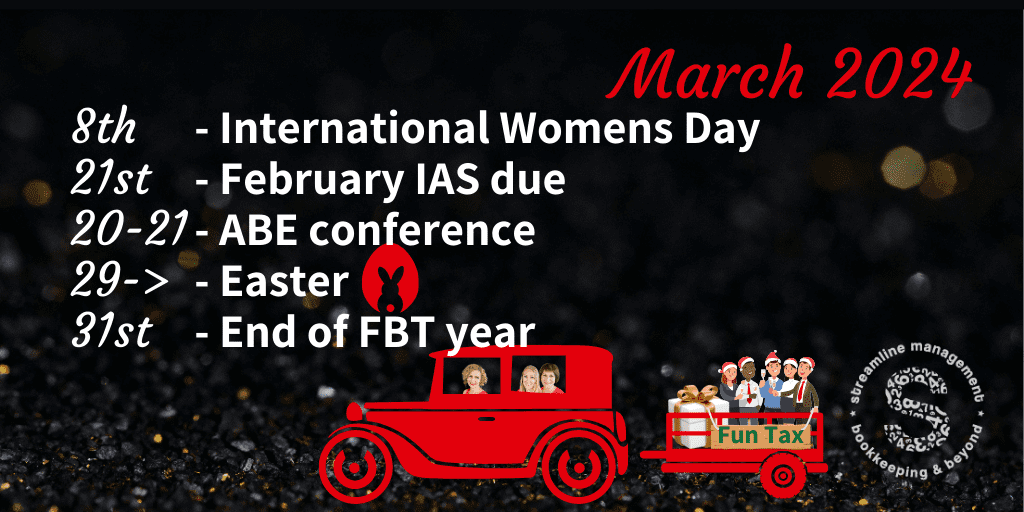

What is happening in March?

Monthly lodgers will need to submit and pay February IAS

We’re heading off the the Accounting Business Expo in Melbourne – Nicole will be speaking on a few panels.

The Easter bunny is hopping over for a long weekend and its the end of the Fringe Benefits Tax year. FBT (or Fun Business Tax) is payable on business fun – parties, restaurant meals, gym memberships, company cars, gifts, paying or reimbursing for personal costs. Ask your accountant for more info and where it might impact your business.

This is it, we’ve reached the absolute last minute!

Lodge and pay your December BAS today to avoid fines.

Haven’t got the funds available to pay in full? Make a payment plan or risk the debt collectors knocking on your door.

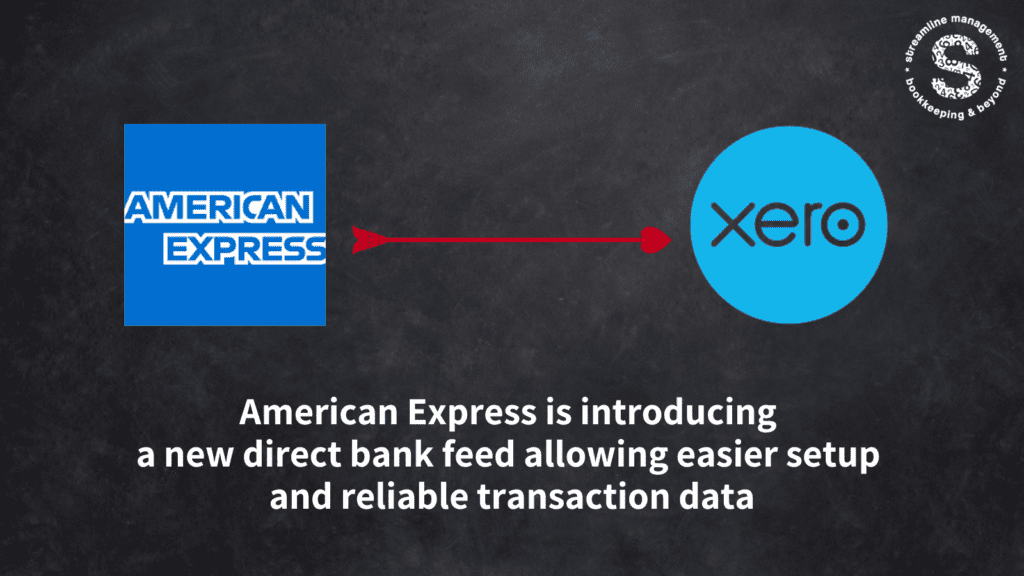

Existing Amex bank feeds will stop working on 28th February – act now to prevent missing data!

Please see notice and instruction from Xero

Make sure you’ve lodged your January IAS if you report to the ATO monthly.

You also need to make payment or arrange a payment plan.

(Don’t forget the December BAS is due in a week)

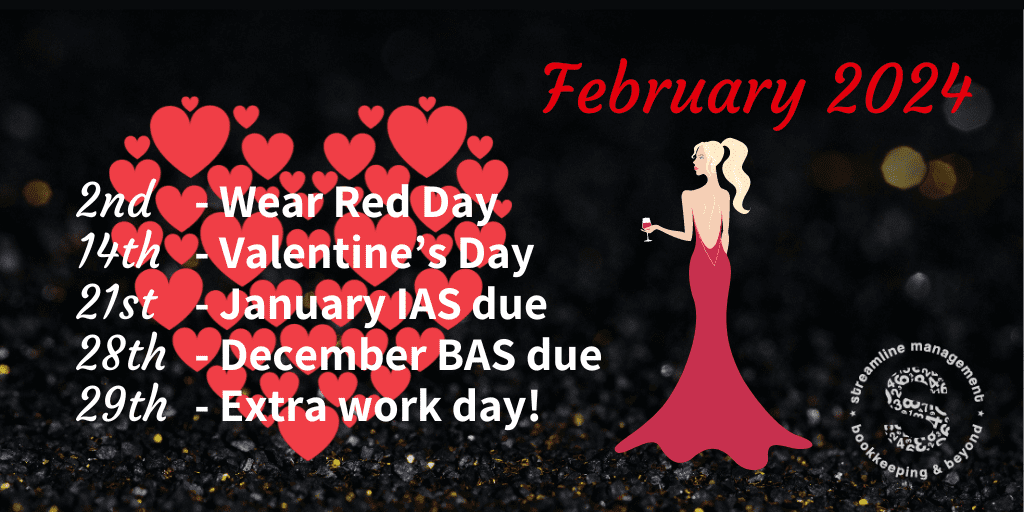

Mark up your diary with important February details.

Wear Red on Friday 2nd February – you can use it as a warm up for Valentines day on the 14th!

ATO deadlines – you can’t avoid those!

And finish off the month with a bonus work day to catch up on that to do list? Score!

to keep up with the news

Be the first to know about critical dates and important gossip!