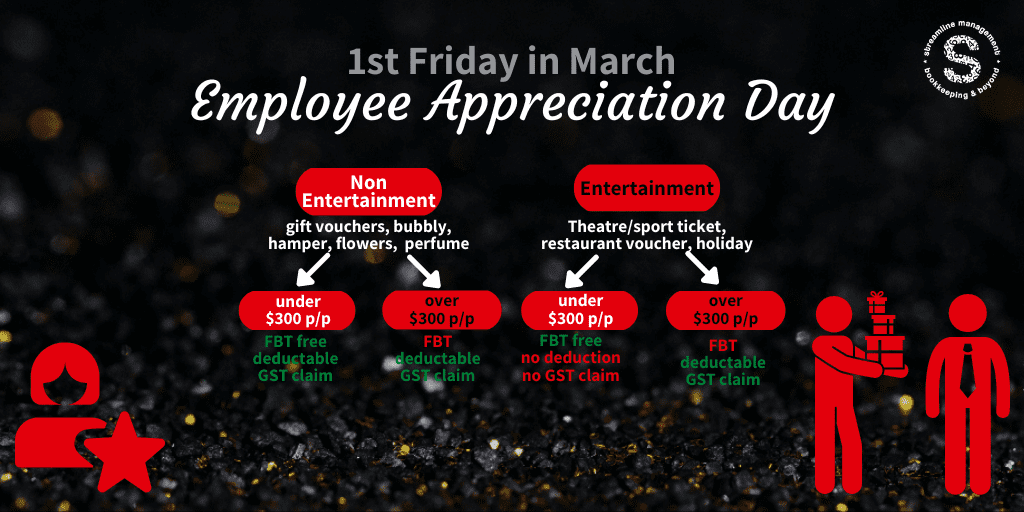

Are you in the drivers seat with FBT tax?

The Fringe Benefits Tax year ends on 31st March, are you aware what might trigger this extra tax for your business?

A fringe benefit is like a payment to an employee, but in a different form to salary or wages.

Your tax agent can assist with calculations, lodgement, and what exemptions might apply. They may also assist you to make smarter decisions to avoid future lodgements and liabilities.