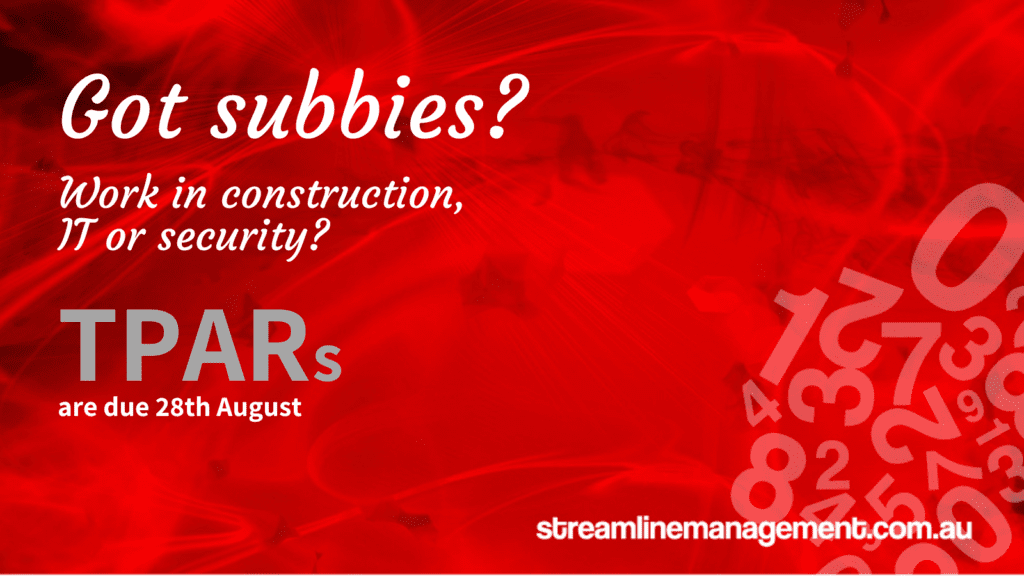

Taxable Payment Annual Report (TPAR) 2023 lodgement deadline

If you have a construction, cleaning, IT, freight/courier or security business you need to report payments made for service to your subcontractors to the ATO.

This is one of the submissions that won’t cost you any money (assuming you lodge on time, otherwise expect a fine).

Construction is very broad – it includes engineering services, architects, communications construction, landscaping, retaining walls, swimming pool installation and wallpapering.

Need a hand to get the paperwork in by 28th August? Ask us to help.