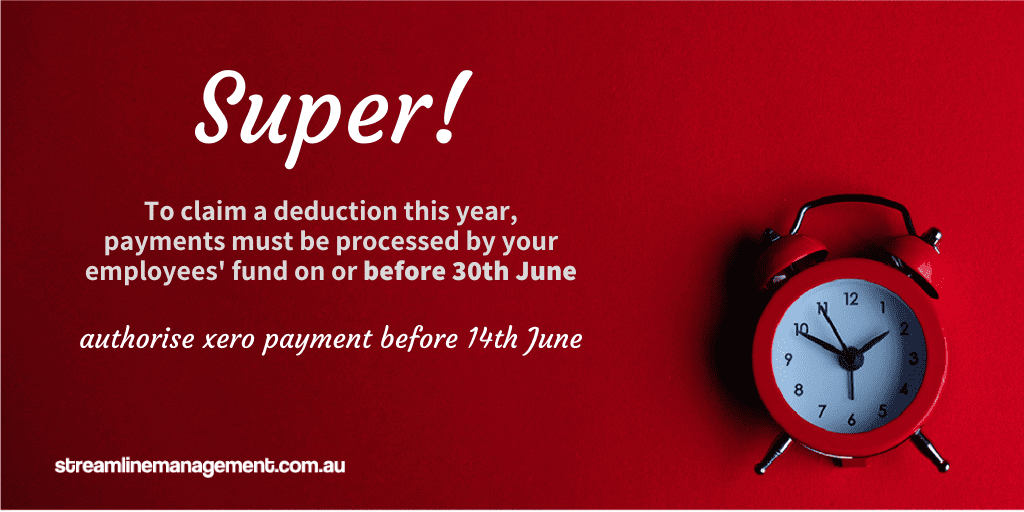

To qualify for a tax deduction in the 2022 financial year, or if you are managing your super cap, super contributions must be received (by fund) by 30th June.

Payments need to be authorised before 14th June to meet the deadline.

The usual final deadline of 28th July still applies if you decide not to pay early.

If you are trying to make the most of super caps – you need to be aware of what a valid salary sacrifice looks like.

Here’s what the ATO says:

Requirements for an effective salary sacrifice arrangement

You need to set up a salary sacrifice arrangement with your employer before you start the work. If your arrangement is not put into place until after you have performed the work, it may be ineffective.

It is advisable that you and your employer clearly state and agree on all the terms of any salary sacrifice arrangement. The contract is usually in writing but may be verbal.

If you enter into an undocumented salary sacrifice arrangement, you may have difficulty establishing the facts of your agreement.

Subject to the terms of any contract of employment or industrial agreement, employees can renegotiate a salary sacrifice arrangement at any time.

Where you have a renewable contract, you can renegotiate amounts of salary or wages to be sacrificed before the start of each renewal.

The contract of employment includes details of your remuneration, with any salary sacrifice arrangement. Your contract can be varied by agreement between you and your employer.

Any salary and wages, leave entitlements, bonuses or commissions that accrued before you entered into the arrangement can’t be part of an effective salary sacrifice arrangement.

Check all the fine print here