Don’t let an unexpected tax bill spoil Christmas.

ATO says: Fringe benefits tax (FBT) is paid by employers on certain benefits they provide to their employees or their employees’ associates (typically family members) in respect of their employees’ employment.

FBT is separate from income tax and is based on the taxable value of the fringe benefits provided.

Entertainment is the most common type of FBT we see.

(It could also include providing a company car or paying personal bills)

What is considered entertainment? It includes events and/or gifts (at any time of year)

ATO says: Entertainment includes, for example:

– business lunches and drinks, cocktail parties and staff social functions

– sporting or theatrical events, sightseeing tours and holidays

– entertaining employees and non-employees (for example clients) over a weekend at a tourist resort or providing them with a holiday.

Recreation includes amusement, sport and similar leisure pursuits (for example, a game of golf, theatre or movie tickets, a joy flight or a harbour cruise).

Some entertainment may be exempt from FBT. For example, food and drink provided to and consumed by current employees on business premises on a working day.

Providing morning or afternoon tea or light meals to your employees on your premises is not entertainment (and, therefore, is not meal entertainment), where you are providing refreshments to enable the employee to complete the working day in comfort, such as tea, coffee, fruit drinks, cakes and biscuits. Light meals include sandwiches and other hand food, salads and orange juice that are intended to be, and can be, consumed on your premises or worksite.

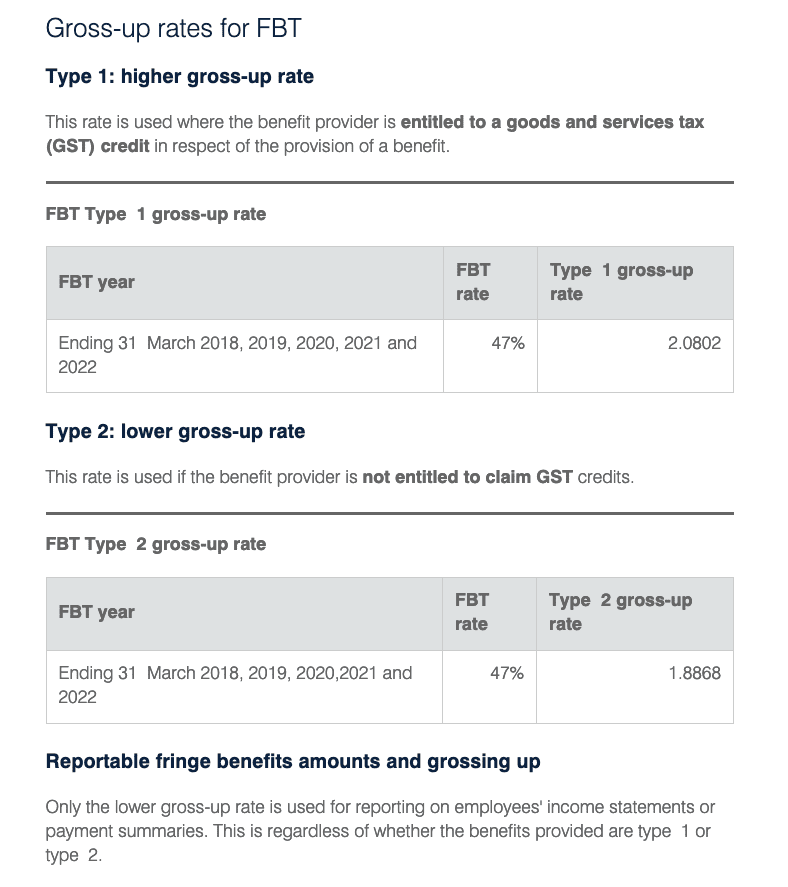

Work out the grossed-up taxable value of the benefits.

‘Grossing-up’ means increasing the taxable value of benefits you provide to reflect the gross salary employees would have to earn at the highest marginal tax rate (including Medicare levy) to buy the benefits after paying tax.

The highest marginal tax rate is 45c (45%) + 2% medicare levy = 47%

This table from the ATO shows the value is approx double the cost paid. So you could end up paying the same again to the tax office.

All the gory FBT details from the ATO can be found here