Its June, so no doubt your staff are asking you about their group certificates (now called STP finalisation).

No so fast!

Reconciliations need to be completed to make sure all payroll info is correct before submitting anything to the ATO. If you transitioned to STP2 during the year you may have some funky looking info. Make sure its due to the transition and not anything more sinister.

When you are happy that all info in your payroll system is correct, you can submit an STP finalisation to the ATO so they know everything is present and accounted for. You need to submit STP finalisations to the ATO by 14th July.

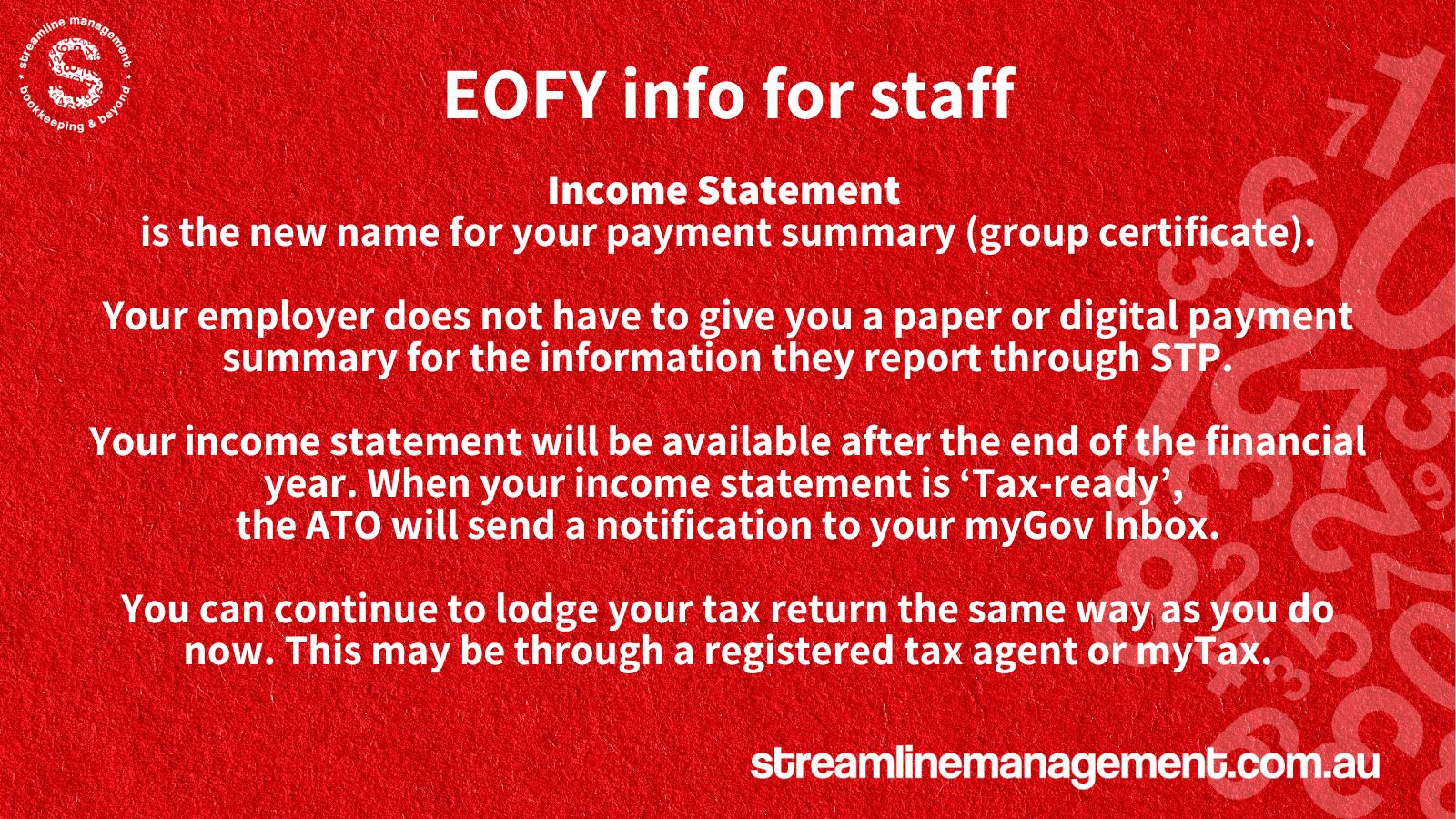

After the ATO accepts your submission (be prepared for delays due to high volume of info being thrown at the ATO, they don’t have enough hands to catch it all), your staff will see their info is ‘tax ready’ in their myGov account. You do not provide any documents to your employees – everything is online.

Employees wanting more info should look here: https://www.ato.gov.au/business/single-touch-payroll/single-touch-payroll-for-employees/what-stp-means-for-employees/

Our clients will receive fully reconciled payroll data for authorisation to submit to the ATO around 10th July.

Calm your farm employees.

The ATO recommends employees holding off submitting personal tax returns until mid August, after they have received prefill info from employers, banks, healthfunds etc. Going off half cocked may result in a bigger delay, so calm your farm people.