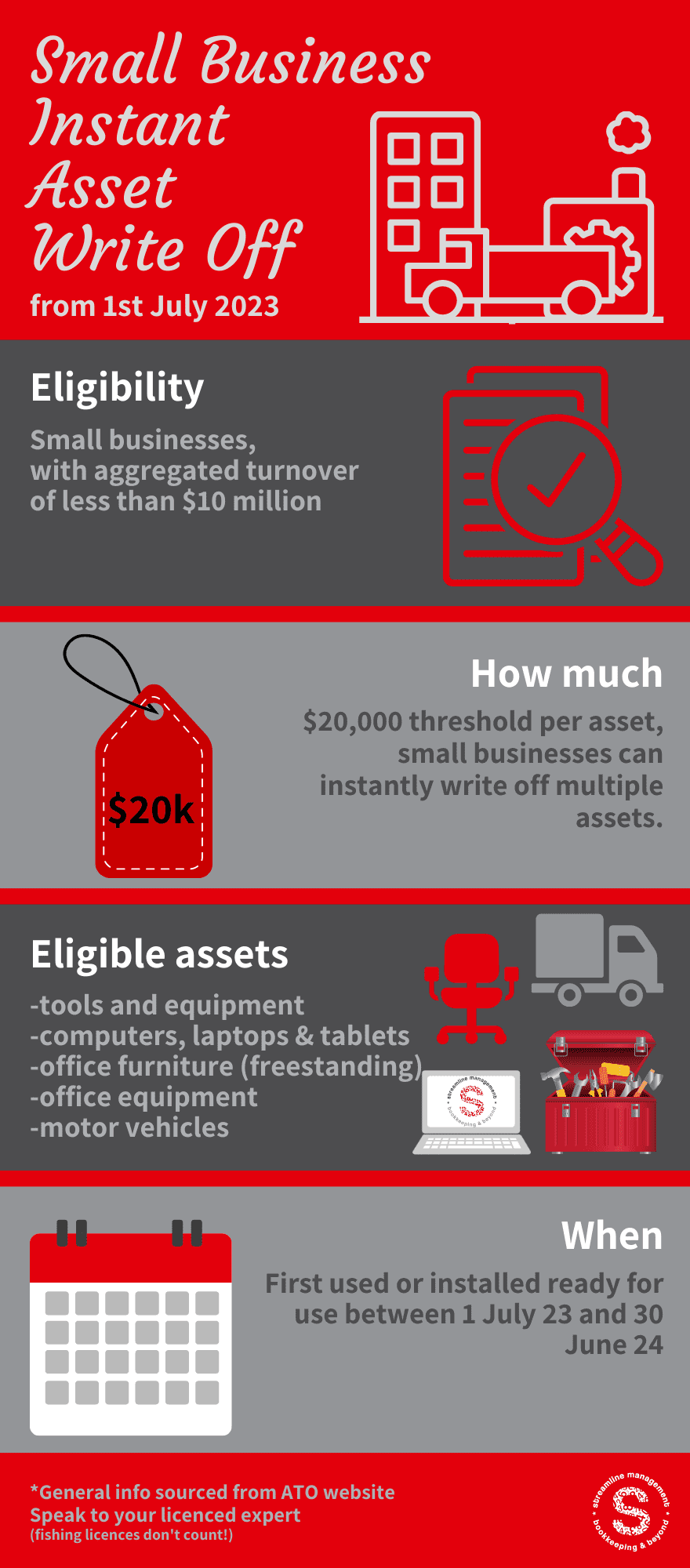

The Instant Asset Write-Off returns on 1st July 2023.

ATO says: Small businesses will be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024.

The $20,000 threshold will apply on a per asset basis, so small businesses can instantly write off multiple assets.

Instant asset write-off can be used for:

– multiple assets if the cost of each individual asset is less than the relevant threshold

– new and second-hand assets.

If you are a small business, you need to apply the simplified depreciation rules to claim the instant asset write-off. It cannot be used for assets that are excluded from those rules.

The instant asset write-off eligibility criteria and threshold have changed over time. You need to check your business’s eligibility and apply the correct threshold amount depending on when the asset was purchased, first used or installed ready for use.

There is lots of fine print – you can find it all here: https://www.ato.gov.au/Business/Depreciation-and-capital-expenses-and-allowances/Simpler-depreciation-for-small-business/Instant-asset-write-off/

Ask your tax agent to explain how to apply the rules to your situation, they are the only people who can legally advise you about tax deductions. And speak to them before you commit yourself and your business to large expenses.