EOFY Super Contributions

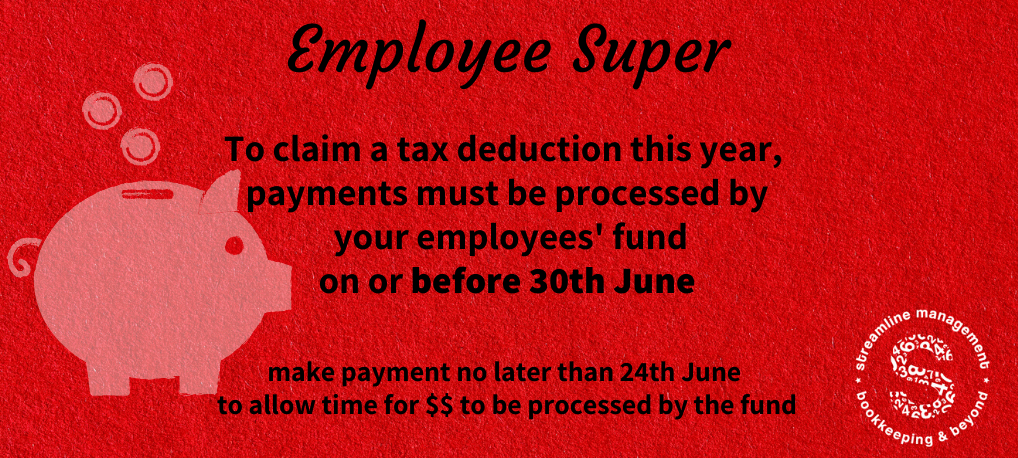

To qualify for a tax deduction in this financial year,

April-June super contributions must be received (by fund) by 30th June.

If you haven’t already, you need to make this payment now.

If your cashflow won’t allow for this, the usual deadline of 28th July still applies.