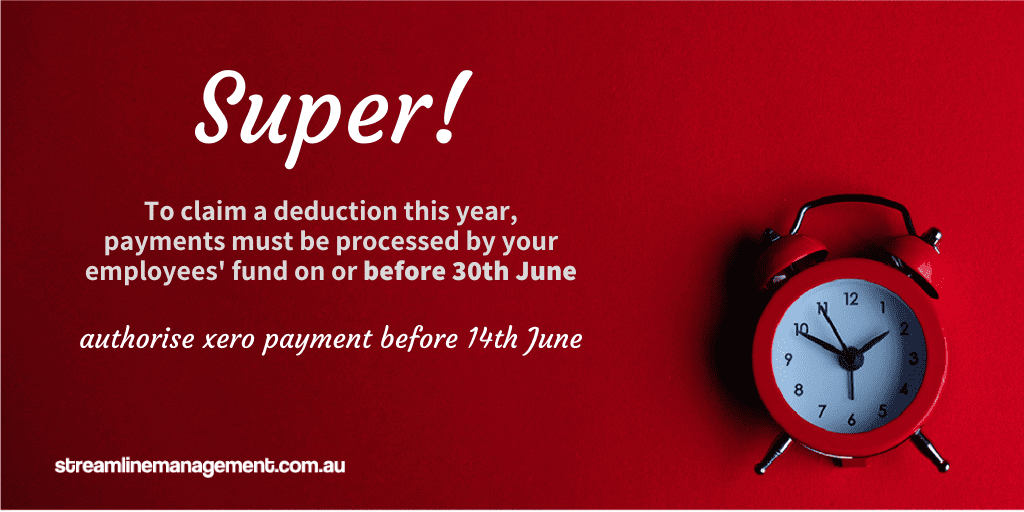

To qualify for a tax deduction in the 2023 financial year,

or

if you are managing your annual super cap,

super contributions must be received (by fund) by 30th June.

Payments should be authorised in Xero by 14th June to meet the deadline.

Before making big decisions, review your year to date (YTD) accounts (perhaps chat to your accountant about strategies to manage your finances?) to see how you are traveling, if your bank account can handle more outgoings and if you need more deductions – there’s probably no point chasing a big loss if you aren’t having a good year. Let your bookkeeper know if you plan to make early payments so they can schedule you in their workflow.

The usual final deadline of 28th July still applies if you choose to not make an early payment.