Grants for NSW businesses

Finer details are not currently available

Click through for infographic for what we do know for now

Speak to your licenced expert for advice on your situation

Finer details are not currently available

Click through for infographic for what we do know for now

Speak to your licenced expert for advice on your situation

Government grants just announced – very little detail available at the moment

New grants program for micro businesses

‘Jobsaver’ employee retention scheme providing cashflow support to businesses to help them retain staff.

An extension to the previously announced business grants

Speak to your licenced expert about your business situation and to keep up with unfolding details

The NSW Government today announced a major new grants package to help tens of thousands of small businesses and people across NSW impacted by the current COVID-19 restrictions.

The package includes grants of between $5000 and $10,000 for small businesses, payroll tax deferrals for all employers.

More information on the small business support grants and changes to the Dine & Discover program will be available shortly on the Service NSW website.

We don’t have enough detail at this stage to act on, but will update you when we do.

The 2021 bugdet has been handed down – but has not yet been enacted into law.

The government has announced:

The demand-driven program is expected to support more than 170,000 new apprentices and trainees by paying businesses a 50 per cent wage subsidy over 12 months for newly commencing apprentices or trainees signed up by 31 March 2022. The subsidy will be capped at $7,000 per quarter per apprentice or trainee.

If you are a sole trader or the owner of a small business in NSW, you may be eligible for the Small Business Fees And Charges Rebate of up to $1500. * terms & conditions apply

The full list of eligible fees and charges (500+) is now available.

You may be eligible to claim back your company vehicle registration!

Online applications open now.

It is now time to submit March actual and April estimated sales to the ATO.

Reports need to be submitted by the 14th April for you to receive the very last JobKeeper payment for March wages.

To assist with the recovery from the impact of COVID-19, the Australian Government is providing support to all eligible employers who engage a new Australian Apprentice.

Any sized business can apply

Got questions? Ask!

If you are a sole trader, the owner of a small business or a not-for-profit organisation in NSW,

you may be eligible for a small business fees and charges rebate of $1500.

The rebate can only be used for eligible fees and charges due and paid from 1 March 2021. It cannot be used for fines or penalties, Commonwealth government charges, rent on government premises, or taxes.

Online applications open from April 2021.

If you’ve been participating in the JobKeeper program – it is now over.

You’ll need to submit your usual monthly report between 1-14th April to receive your final payment.

Don’t forget to remove topups from staff pay templates!

Not sure how your business is performing? Ask your adviser to review your situation and help you plan the way forward.

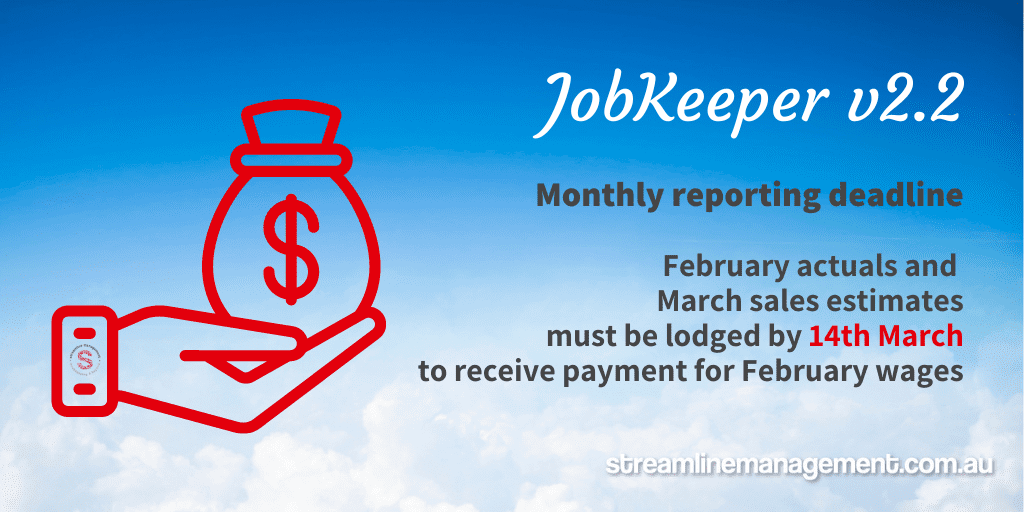

If you are participating in JobKeeper v2.2 – it is now time to submit February actual and March estimated sales to the ATO.

Reports need to be submitted by the 14th March for you to receive JobKeeper payment for February wages.

to keep up with the news

Be the first to know about critical dates and important gossip!