Back to school, back to work!

Don’t forget to keep staff take annual and/or sick leave balances up to date.

Don’t forget to keep staff take annual and/or sick leave balances up to date.

Super payment due dates occur quarterly. If you don’t pay an employee’s super guarantee (SG) amount in full, on time and to the right fund, you must pay the super guarantee charge (SGC).

The SGC is more than the super you would have otherwise paid to the employee’s fund and is not tax deductible.

You will need to complete an SGC statement and submit it to the ATO, this is used to calculate fines and penalties (some to compensate staff for lost earnings, some to punish you for naughtiness).

Hopefully this is a mistake you only make once!

Fair Work has updated the National Employment Standards (NES).

FairWork says: From 1 January 2024, the National Employment Standards (NES) includes a right to superannuation contributions. This means that unpaid or underpaid superannuation can be enforced under the Fair Work Act by more employees (as well as by an employee organisation or us).

Make sure you provide new employees with the current version of the National Employment Standards as part of your onboarding process.

Ask us for help if you have no idea about an employee onboarding process – we can help keep you compliant!

Fair Work has updated the rules about deductions from employee wages.

New rules apply for employee authorised deductions from pay that are either one-off or recurring and for specific amounts or for amounts that change from time to time.

These are called employee authorised deductions and the employee needs to give their permission in writing. Examples of these deductions include payments to a health fund or union fees.

Need help with payroll? Ask us to give you a hand

Sick of conversations with the ATO about missing deadlines?

What actions do you need to take this year to avoid the tax office jailhouse?

Need help? That’s Alright, You’ll Never Walk Alone, we’ll be your Good Luck Charm!

Small business ownership is much like snakes and ladders – you take a massive step up and then you slide backwards.

Unlike the game, the more you play in your business – the luckier you get. Gather great people around the board, they can support you as you slither down and hold the ladder as you climb up.

Sing out if you’d like us to blow on the lucky red dice!

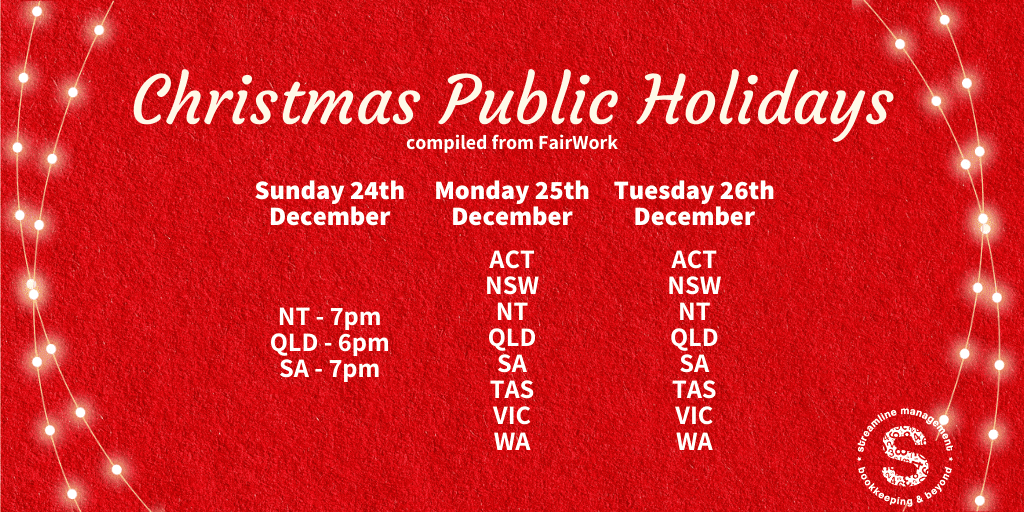

Christmas time wages – so easy!

If you are closing your office you need to know about public holidays and how they effect wages for your team. Different states declare different public holidays, part-time staff need to be paid their normal hours, they do not need to make up the time on another day.

If your workplace remains open, you need to know about public holiday payrates/loadings and minimum shift lengths.

Check out all the details here or ask us to help.

Fair Work has updated the rules about fixed term contracts

From 6 December 2023, new rules apply when engaging employees on fixed term contracts.

A fixed term contract terminates at the end of a set period (for example, the contract ends on a set date or after a set period of time or a season).

The new rules include a requirement for employers to give any employees they’re engaging on a new fixed term contract a Fixed Term Contract Information Statement (FTCIS).

Need help with payroll? Ask us to give you a hand

Thinking about rewarding staff with a bonus?

Don’t forget super is likely to apply and you’ll need to use the schedule 5 tax scale to work out the tax to withhold.

If you don’t process and report the payment properly – you can’t claim a tax deduction.

If you’ve fallen behind with your tax lodgements – the window to lodge without late fines is closing.

If eligible overdue forms are lodged between 1 June 2023 and 31 December 2023, any failure to lodge penalty applying to the late lodgment will be remitted.

There really is little time left before everyone packs up for the year – act now!

to keep up with the news

Be the first to know about critical dates and important gossip!