Fairwork and COVID

Not sure of the best way to keep your employees safe and protect your business?

FairWork has update their website with more info on Australian workplace laws and COVID.

Not sure of the best way to keep your employees safe and protect your business?

FairWork has update their website with more info on Australian workplace laws and COVID.

Sun. Sea. Sand. That sounds like a lovely holiday! Here in Sydney we can only imagine. While we might not be playing in the sand, we shouldn’t be burying our heads in the sand either.

You may need to review your setup to keep your head above water. You might be considering standing down your employees as the workplace is closed – make sure you stay on the right side of FairWork,

So you want to stand down your employees during the lockdown – make sure you follow FairWork guidelines. They have updated their website today.

Have you thought about hiring an intern? As a small business owner, wouldn’t it be wonderful to get some free labour from someone who needs experience in your industry?

But before you bring someone into your business make sure you are on the right side of fairwork!

STP finalisation for staff is due by 31st July – make sure you reconcile your payroll accounts BEFORE you press the button.

If we manage the whole payroll shebang for you, we have reconciled your accounts and need your permission to finalise – make sure you review and sign.

If we are supporting you, but you are the STP submitter for your business, we have sent you instructions on how to finalise.

Who? What? When? Where? Why? Reach out if you need a hand to sort out your payroll!

Government grants just announced – very little detail available at the moment

New grants program for micro businesses

‘Jobsaver’ employee retention scheme providing cashflow support to businesses to help them retain staff.

An extension to the previously announced business grants

Speak to your licenced expert about your business situation and to keep up with unfolding details

Disgruntled workers aren’t great in your business, but how do you keep your workers gruntled?

Are they wanting flexible working conditions?

When granting flexible options for your team – make sure you are not up for unexpected extra costs.

Do several members of your family have the same taste in work clothes because you work together in a family business?

From 1st July 2021 the exemption for businesses to regularly report wages for closely held employees (owners/directors/shareholders & their family members) is being removed.

Single Touch Payroll (STP) reporting for closely held employees must be at least quarterly, declaring a wage as at 30th June each year will no longer be acceptable.

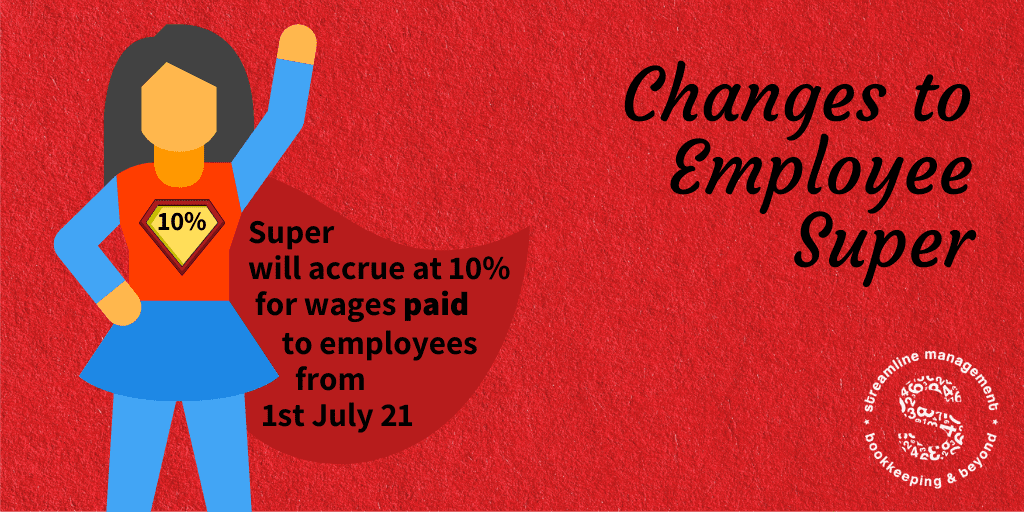

Don’t forget superannuation paid on behalf of all employees (including owners/directors) has increased to 10% for wages paid (bank transfer) on or after 1st July 2021 (based on payment date not period worked).

Annual concessional super contribution caps have increased to $27,500 for the 2021/22 financial year.

I forgot is not something you want to be saying often about compliance deadlines!

to keep up with the news

Be the first to know about critical dates and important gossip!