Delivering gifts down the chimney this year? Don’t get stuck with extra tax to pay!

Best to refresh your memory on the allowable deductions and FBT rules, before the hitting the shops, so you don’t end up with any surprise tax to pay!

The following information is courtesy of the Australian Bookkeepers Network:

Christmas is traditionally a time of giving – including employers showing gratitude towards staff and clients/suppliers for their loyalty throughout the year. With the right approach, it is possible to enjoy some tax benefits out of your generosity, and also avoid Fringe Benefits Tax (FBT). But as always with tax, the landscape is layered with complexity. The following is a general summary of the tax treatment of Christmas giving.

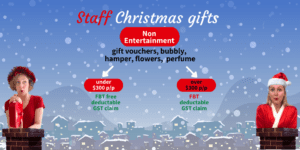

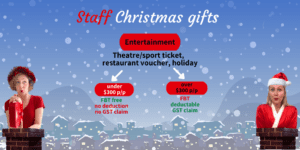

Gifts to Staff

Non-entertainment gifts to staff (such as Christmas hampers, bottles of alcohol, gift vouchers, pen sets etc.), are tax deductible and you can claim GST credits, irrespective of cost. Note however that you can generally avoid paying FBT if you keep the gift under $300. If this threshold is exceeded, FBT will apply.

Entertainment gifts to staff (such as tickets to movies/theatre/amusement park/sporting events, holiday airline tickets etc.) which are under $300 will not attract FBT, but are not income tax deductible, and you can not claim GST credits. If over $300, FBT will apply, but a tax deduction and GST credits can be claimed. With FBT rate sitting at 47%, the tax deduction and GST credits available is unlikely to provide a better tax outcome than avoiding FBT by keeping the gift under $300.

Gifts to Clients/Customers/Contractors/ Suppliers

No FBT is payable, irrespective of the type of gift and irrespective of cost. However, where a gift constitutes entertainment, no GST or tax deduction can be claimed. Thus, at least from a tax standpoint, it’s better to provide non-entertainment gifts to clients (Christmas hampers, bottles of alcohol, gift vouchers, pen sets) and, in doing so, enjoy a tax deduction and GST credits.