Are you planning to provide Christmas gifts to your customers?

Need to know if you can claim a tax deduction?

Read on

ATO says:

Ruling

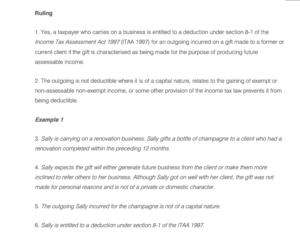

1.Yes, a taxpayer who carries on a business is entitled to a deduction under section 8-1 of the Income Tax Assessment Act 1997 (ITAA 1997) for an outgoing incurred on a gift made to a former or current client if the gift is characterised as being made for the purpose of producing future assessable income.

2. The outgoing is not deductible where it is of a capital nature, relates to the gaining of exempt or non-assessable non-exempt income, or some other provision of the income tax law prevents it from being deductible.

https://www.ato.gov.au/law/view/document?DocID=TXD/TD201614/NAT/ATO/00001