Are you planning to host Christmas celebrations for your staff and/or business associates?

The Fringe Benefits Tax (FBT) grinch may ruin your fun with a surprise tax bill!

The following information is courtesy of the Australian Bookkeepers Network.

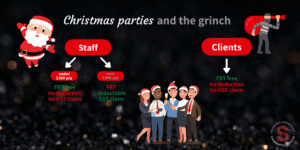

Parties

Instead of (or as well as) gifts, it’s quite common for employers to host a Christmas Party for their staff (often including spouses) at a restaurant.

Where this is the case, the total cost will generally be exempt from FBT provided the per-head cost (dinner and drinks) is kept to under $300 per person. This is known as the Minor Benefits Exemption. The downside of using the Minor Benefit Exemption is that the meal entertainment is not tax deductible, and nor can you claim a GST credit. To enjoy this exemption the employer must use the Actual Method for valuing FBT meal entertainment. The Actual Method is the default method for valuing meal entertainment, and no formal ATO election is required to use this method. Under the Actual Method, an employer pays FBT (in the absence of an exemption) on all taxable meal entertainment provided to employees and their associates such as spouses.

Not sure what it’s all about? Ask your accountant to explain the fine print.