Streamline Management News

* This is generic info to give you a few pointers and should never be relied on as specific accounting advice.

Contact your expert (not your mates at a BBQ or the guy trying to sell you something) to discuss your situation.

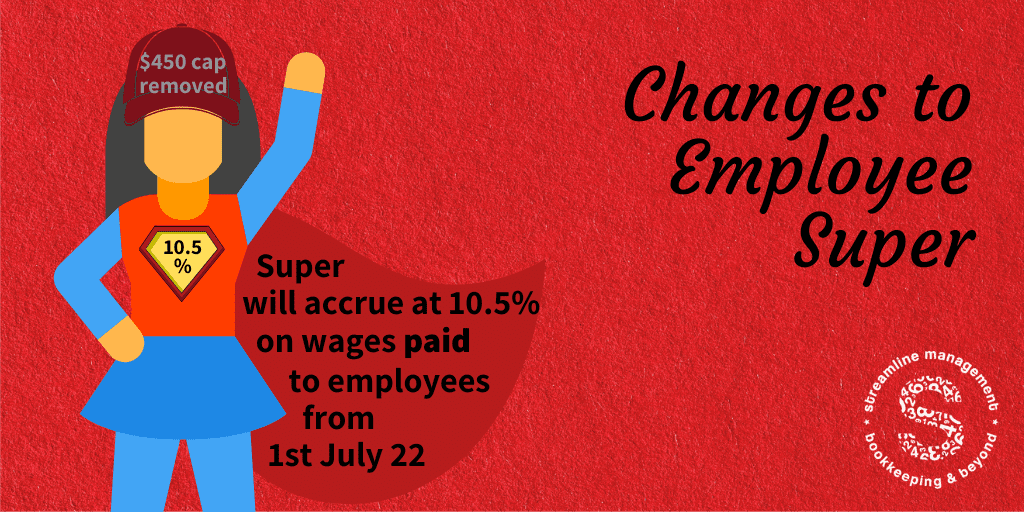

Super is increasing from 1st July 2022

Superannuation paid on behalf of ALL employees (including owners/directors) will increase to 10.5% for wages paid (bank transfer) on or after 1st July 2022.

The $450 per month threshold will no longer be applicable.

Super – Last chance to pay super in 2022

Last chance!

Approve super in Xero by 2pm today to ensure payment is received by 30th June.

(If you’re not chasing the earlier tax deduction, then the usual deadline of 28th July still applies.)

2021/2022 financial year is coming to an end

EOFY

Are you prepared?

As always, speak to your expert about your business circumstances – the salesperson at the dealership or officeworks is not licenced to give you advice, they are trying to sell you something.

Buyer beware!

Trial Technology Day – small business apps

For us, this means apps.

Our app stack has changed our business and allowed us to work smarter and support our clients better.

Wherever you are at, there’s an app for that! Sing out if you’d like a hand to select the next app for your small business. There are thousands of apps out there and it can be a bit overwhleming to get started, we’d love to help you ‘streamline’ your business.

Email Week – Business Email Compromise

This Email Week take a look at your email security.

Why? It could cost you in money (fraud), time and reputational damage!

What can you do? There are plenty of resources to reduce risk or what to do if you do end up a victim. We’ve found a couple of government sites to help you.

Yoyo Day

Small business owners – do you ever feel like a yoyo?

Round and round in circles.

Constant up and down.

STP2 – Sit Tight Please

Single Touch Payroll (STP) 2 is coming

What do you need to do?

Nothing right now, your accounting software will do most of the work in the background – Xero has an extension to December 2022, so there is plenty of time to transition.

Sit Tight Please (STP).

EOFY 2022

Are you ready?

You can’t make sensible decisions without data.

Bring your data file up to date and respond to your bookkeepers questions.

Don’t spring last minute questions on your experts – schedule a meeting with plenty of notice!

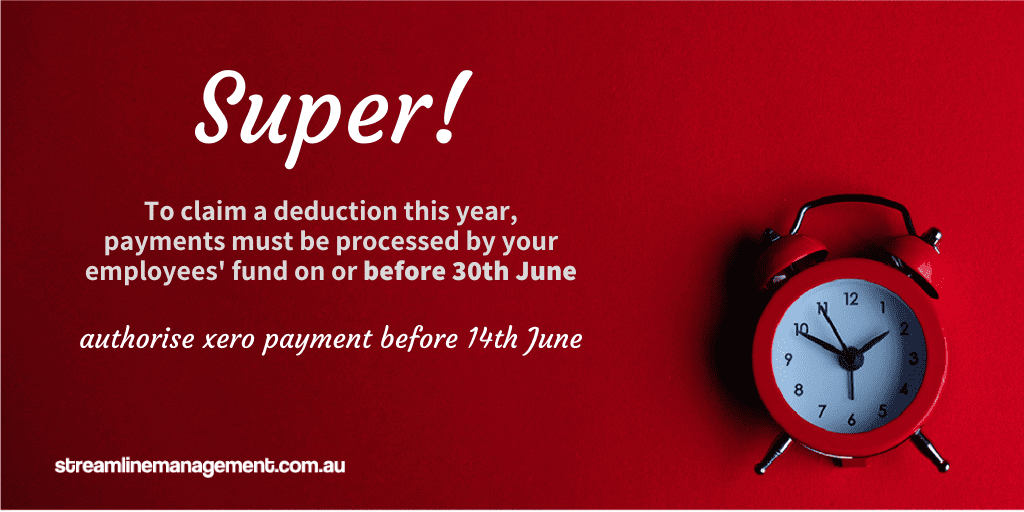

EOFY Super Contributions

To qualify for a tax deduction in the 2022 financial year, or if you are managing your super cap, super contributions must be received (by fund) by 30th June.

Payments need to be authorised before 14th June to meet the deadline.

The usual final deadline of 28th July still applies if you decide not to pay early.

If you are trying to make the most of super caps – you need to be aware of what a valid salary sacrifice looks like.

Nothing to Fear Day – ask for help with your accounts

Have you gotten yourself into a bit of a muddle and are frightened to ask for help for fear of looking like a fool?

Relax – we’ve seen some real doozies.

You might be a few years behind, have incomplete records, perhaps you aren’t really sure how GST works, or don’t know much about managing a team of workers – none of that shouldn’t stop you from reaching out for assistance.

We’ve been helping small business owners straighten out their records and get systems in place since 1997. We can help you too.

FOLLOW US

to keep up with the news

Subscribe to our Newsletter

Be the first to know about critical dates and important gossip!