How do you show your team that you appreciate them?

If you’re thinking of conveying recognition with a gift – keep the fun business tax (or Fringe Benefits Tax if you want to use the technical term) in mind.

The Australian Bookkeepers Network has created this summary:

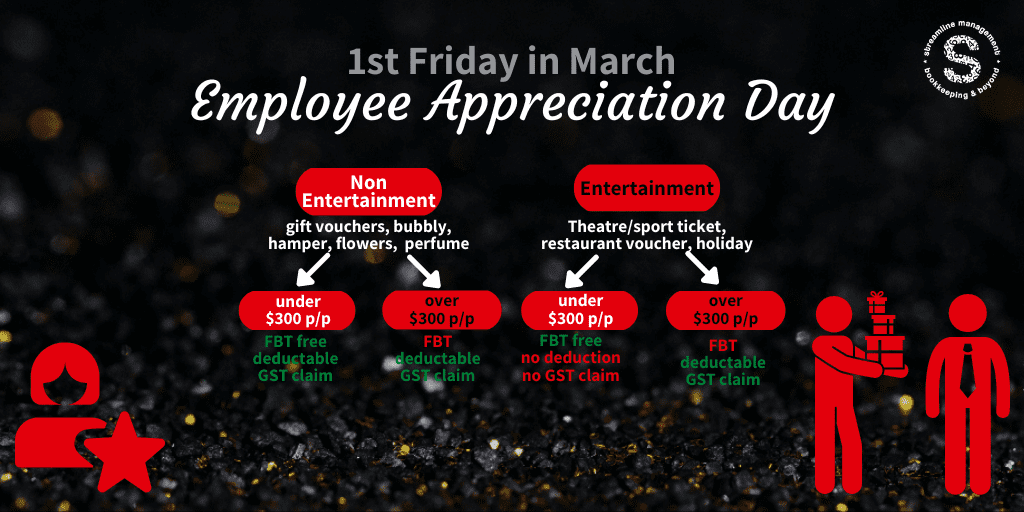

Non-entertainment gifts to staff (such as Christmas hampers, bottles of alcohol, gift vouchers, pen sets etc.), are tax deductible and you can claim GST credits, irrespective of cost. Note however that you can generally avoid paying FBT if you keep the gift under $300. If this threshold is exceeded, FBT will apply.

Entertainment gifts to staff (such as tickets to movies/theatre/amusement park/sporting events, holiday airline tickets etc.) which are under $300 will not attract FBT, but are not income tax deductible, and you can not claim GST credits. If over $300, FBT will apply, but a tax deduction and GST credits can be claimed. With FBT rate sitting at 47%, the tax deduction and GST credits available is unlikely to provide a better tax outcome than avoiding FBT by keeping the gift under $300.

ATO details are here: https://www.ato.gov.au/businesses-and-organisations/hiring-and-paying-your-workers/fringe-benefits-tax/how-fringe-benefits-tax-works

Employee of the month awards and a public pat on the back can also be powerful (and cost effective).