On 6th December 2023 the ATO released a new Tax Ruling in response to a High Court decision about classifying workers.

We’ve trawled through various ATO pages and here are the key points:

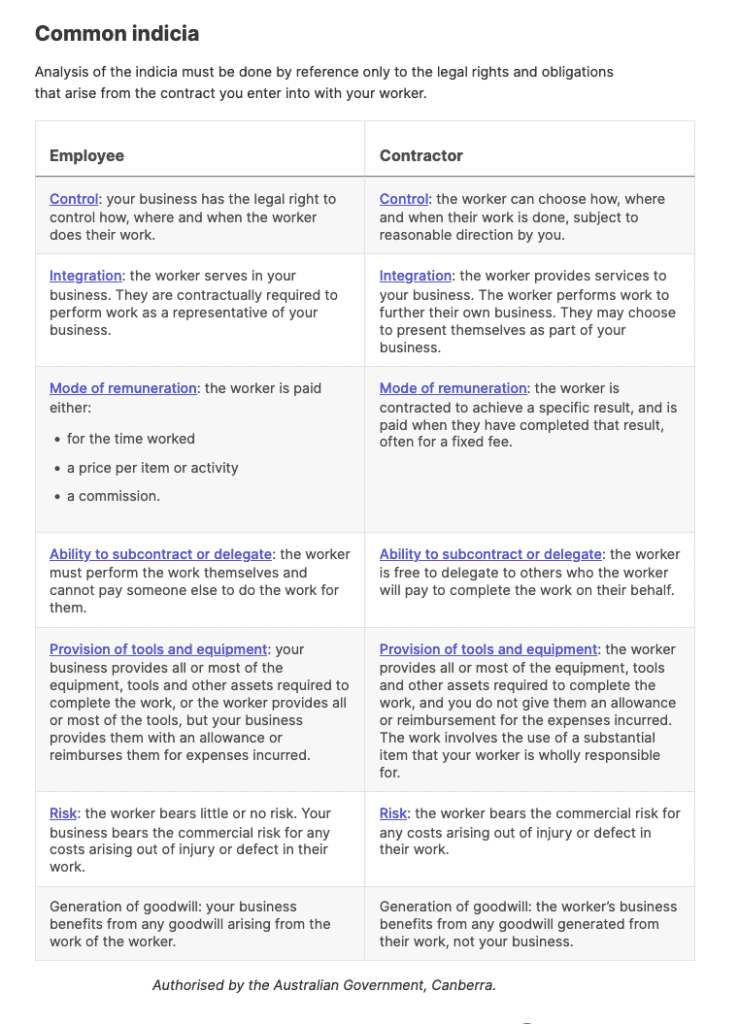

The High Court judgments clarify that the totality of the relationship between a worker and an employer consists of the legal rights and obligations arising from the contract between the parties.

You are responsible for classifying your worker for tax and super purposes and you need to get it right. If you make an incorrect decision, you may face penalties.

The following workers are always treated as employees:

– apprentices

– trainees

– labourers

– trades assistants.

Apprentices and trainees do both work and recognised training to get a qualification, certificate or diploma. They can be full-time, part-time or school-based and usually have a formal training agreement with the business they work for. This is registered through a state or territory training authority or completed under a relevant law.

Companies, trusts and partnerships are always contractors

An employee must be a person. If you’ve hired a company, trust or partnership to do the work, this is a contracting relationship for tax and super purposes. The people who do the work may be directors, partners or employees of the contractor but they’re not your employees.

Hiring individuals

If you’ve hired an individual, the details within the working agreement or contract determine if they are a contractor or employee for tax and super purposes. The agreement or contract can be written or verbal.

To work out if your worker is an employee or contractor, you need to determine whether your worker is serving in your business or is running their own business. You do this by reviewing the legal rights and obligations in the contract you entered into with your worker.

Contracts are usually written, but there may also be oral contracts or a hybrid. Your contract may also be varied based on your or your worker’s conduct. Any label which you and the worker use in your contract to describe your relationship (such as ‘independent contractor’) will not determine or be relevant to how your relationship is characterised.

The table below outlines each indicia and some features that may points towards or against a finding of employment. No single indicia is definitive and they should not be applied as if they are a checklist.

It’s against the law for a business to incorrectly treat their employees as contractors. Businesses that do this are illegally lowering their labour costs by:

– not meeting their tax and super obligations

– denying workers their employee entitlements.

Businesses risk receiving penalties and charges, including:

– PAYG withholding penalty – for failing to deduct tax from worker payments and send it to us

– super guarantee charge including interest charges and an administration fee

– additional super guarantee charge of up to 200%.

You can only claim a deduction for the following payments if you comply with the PAYG withholding and reporting requirements for that payment. These are payments:

– of salary, wages, commissions, bonuses or allowances to an employee

– of directors’ fees

– to a religious practitioner

– under a labour hire arrangement

– for a supply either wholly or partly of services where the contractor has not provided you with their Australian business number (ABN).

If you should have withheld a PAYG amount from a payment but you didn’t withhold any of it, you will lose your deduction for that payment.

Can we sum it up for you? Yes!

– If you call a workers ‘contractors’ or ‘freelancers’ and therefore decide you don’t need to withhold tax/pay super/accrue leave you could find yourself in a world of expensive pain.

– If you legitimately engage a sole trader for their labour, you’ll probably need to pay super on their behalf (and follow all the usual rules for employee super). If you hire a company/trust/partnership as a contractor, you’d probably avoid super liabilities.

– Sham contracting is illegal. And if the relationship goes sour, you could get hit up for leave, PAYGW and super on top of what you’ve already paid, and it won’t be considered a tax deduction.

– Ask for help if you need it!

References:

https://www.ato.gov.au/businesses-and-organisations/hiring-and-paying-your-workers/employee-or-contractor/how-to-work-it-out-employee-or-contractor

https://www.ato.gov.au/businesses-and-organisations/hiring-and-paying-your-workers/employee-or-contractor/difference-between-employees-and-contractors

https://www.ato.gov.au/businesses-and-organisations/hiring-and-paying-your-workers/employee-or-contractor/employees-treated-as-contractors

https://www.ato.gov.au/businesses-and-organisations/hiring-and-paying-your-workers/payg-withholding/in-detail/removing-tax-deductibility-of-non-compliant-payments