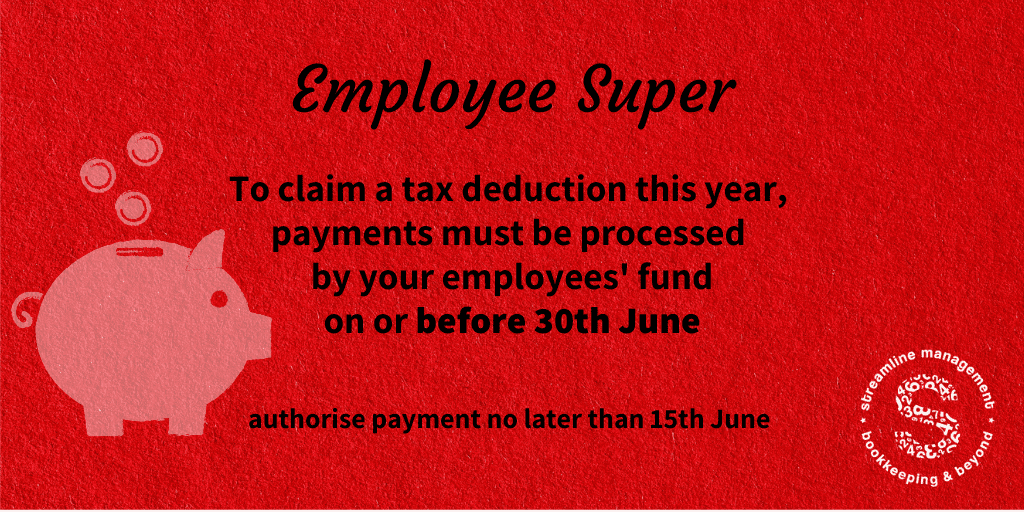

To qualify for a tax deduction in the 2021 financial year,

or

if you are managing your super cap, super contributions must be received (by fund) by 30th June – that means you’ll need to make payment by mid June.

Review your situation and make sure you have enough funds available.

The usual deadline of 28th July still applies for June quarter super if you are not chasing the tax deduction or maximising your super cap.

Want to find out more about how super works for employers? Check out the ATO website ATO super for employers