JobKeeper2 is about to start!

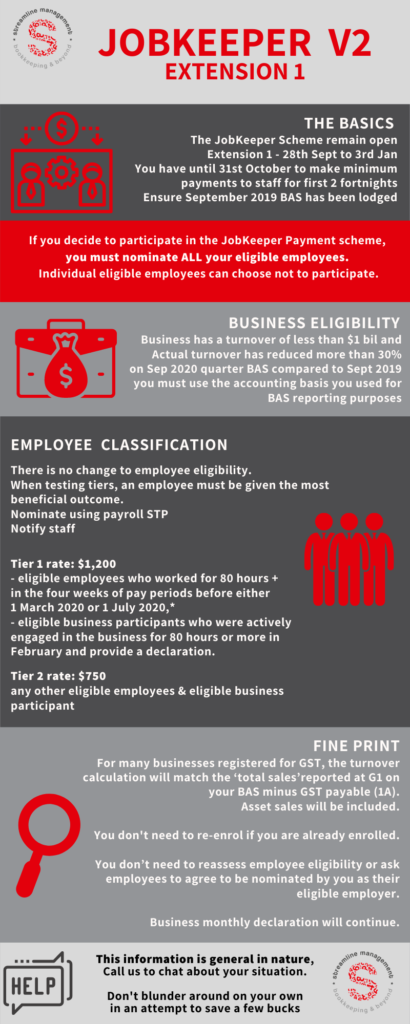

JobKeeper1 ends on Sunday. Any PAYMENT made after Sunday will not count in JobKeeper1 and is not reimbursable. You may need to update your pay templates to remove topups if you are no longer eligible.

There are more conditions for round 2 – ask for help if you need it.

Measure ACTUAL turnover for the September 2020 quarter compared to September 2019 – same method as your BAS. Decline must be 30% or more to be eligible for JobKeeper2 payments. You won’t be able to finalise this until the end of the quarter (after JobKeeper 2 starts, that’s ok, the ATO is allowing extra time to make the first 2 topup payments). You will need to include sale of assets. You do not need to re-enrol on the ATO portal for JobKeeper2.

Next, confirm which tier applies to each employee. (Don’t forget the one in all in rule still applies.) You must give each employee the most favourable outcome. The testing is not straight forward. See ATO link below.

You have until 31st October to make topup payments for first 2 fortnights.

Employees do not need to complete a new form.

Keep staff informed.

ATO: How to calculate 80hours – tier 1 or tier 2 https://www.ato.gov.au/General/JobKeeper-Payment/Payment-rates/80-hour-threshold-for-employees/

ATO: Paying Employees https://www.ato.gov.au/General/JobKeeper-Payment/Payment-rates/Paying-your-eligible-employees/