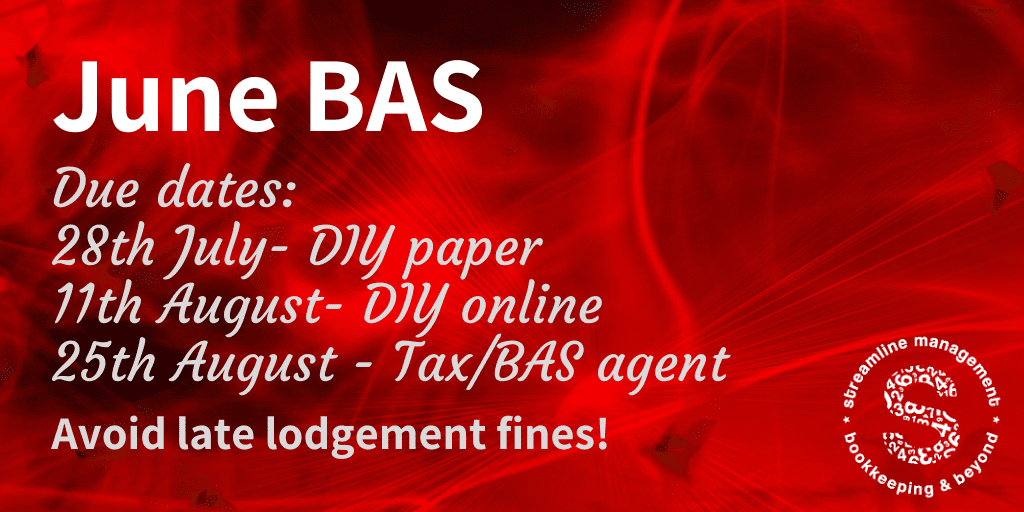

Did you know the June BAS has 3 different due dates depending on the lodgement method?

Regardless of method – on time lodgement is important – fines can be imposed for late lodgement.

If you are still DIYing with the pinkish/salmony paper – its due 28th July – now!

If you’re a more modern DIYer and use the business portal – due 11th August.

If you’ve decided DIY is for mugs – your BAS or Tax Agent has until 25th August to lodge on your behalf. You will need provide details and respond to requests for extra data. Don’t leave it to the last minute to provide your data, your agent will need to slot the work into their schedule.

Each and every BAS needs to be authorised by you – blanket OKs are not OK with the ATO.

Even if you can’t pay the BAS – you’ll be better off lodging to avoid fines, you can make a payment plan while times are tough.