How much fun is owing a small business??!

Sometimes small business owners forget they are not the company – it is a separate entity. That means money in the company bank account is not your personal money.

If I want some more money – what should I do?

Speak to your expert before you do anything – there are a few options and they have different tax consequences, you’ll need to budget for tax payable.

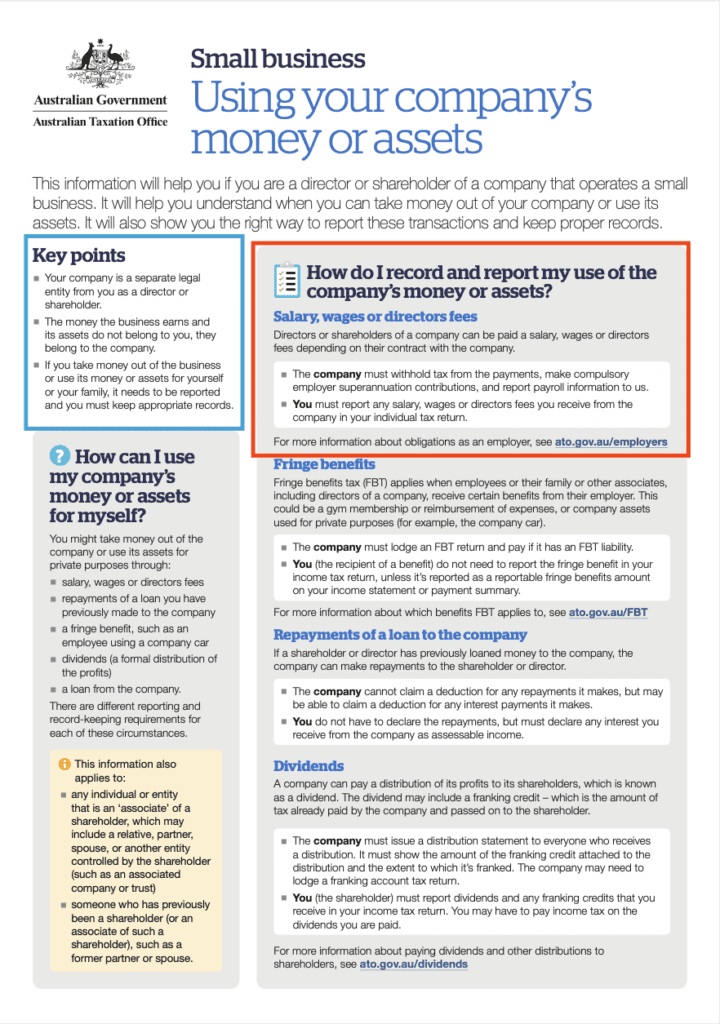

The tax office has produced a fact sheet to give you a basic overview.

Your company can pay you wages/salary/directors fees – these need to be processed through your payroll system, tax needs to be withheld and super is probably payable.

Loans – Perhaps you previously lent the company money and now you want it back. You can withdraw your money from your business.

Or you might want to borrow some money, you intend to pay it back shortly. You need to make sure you meet all the conditions. A loan agreement might be required. Division 7A is something you may have heard about, Div7A if you’ve encountered it often!

Dividends can be paid to shareholders to distribute profits (same as your stockmarket shares). You will need help from your accountant to manage this process.

Make sure you ask your tax agent about your personal situation and future plans – the tax consequences of any action could be huge.