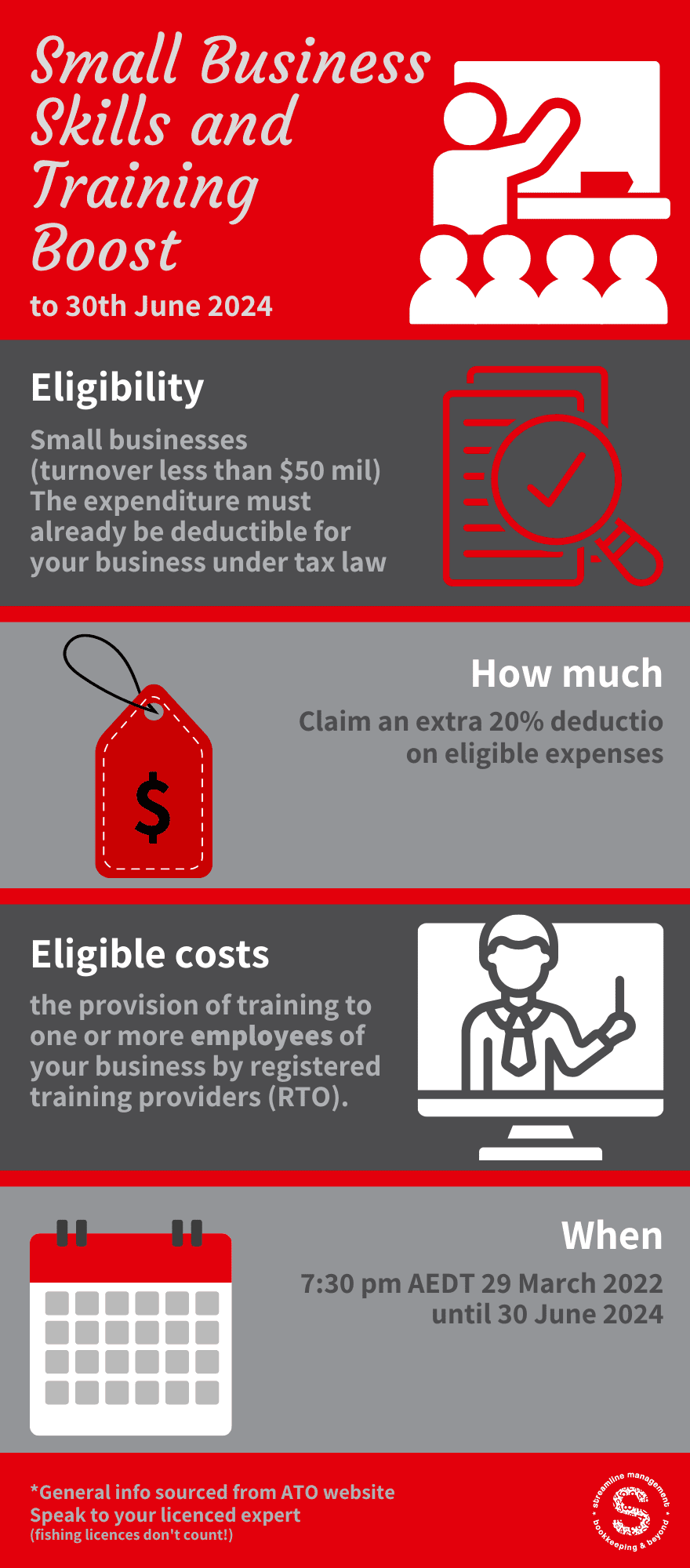

This brand new piece of legislation has been back dated, you can claim for expenses in the last 15 months and the next 12 months.

What is it?

An extra deduction above the actual cost of purchase. If you spend $1,000, you can claim $1,200 in your tax return. This lowers your taxable profit, so you pay less tax.

It does not mean a refund from the ATO. Ask your tax agent for assistance.

What is covered?

ATO says: The expenditure must be:

- for the provision of training to employees of your business (non-employee business owners such as sole traders, partners in a partnership or independent contractors are excluded), either in-person in Australia, or online

- charged, directly or indirectly, by a registered external training (RTO) provider that is not you or an associate of yours

- already deductible for your business under taxation law

- incurred within a specified period (between 7:30 pm AEDTor by legal time in the ACT on 29 March 2022 and 30 June 2024).

What should you do?

Review your training and professional development expenses for the last 15 months for your tax agent to claim in your 2022/23 tax return.

All the ATO details are here: https://www.ato.gov.au/Business/Income-and-deductions-for-business/Deductions/Small-business-skills-and-training-boost/?=Redirected_Skillstrainingboost