This retrospective legislation ends this week.

However, you can claim expenses you’ve already paid in running your business.

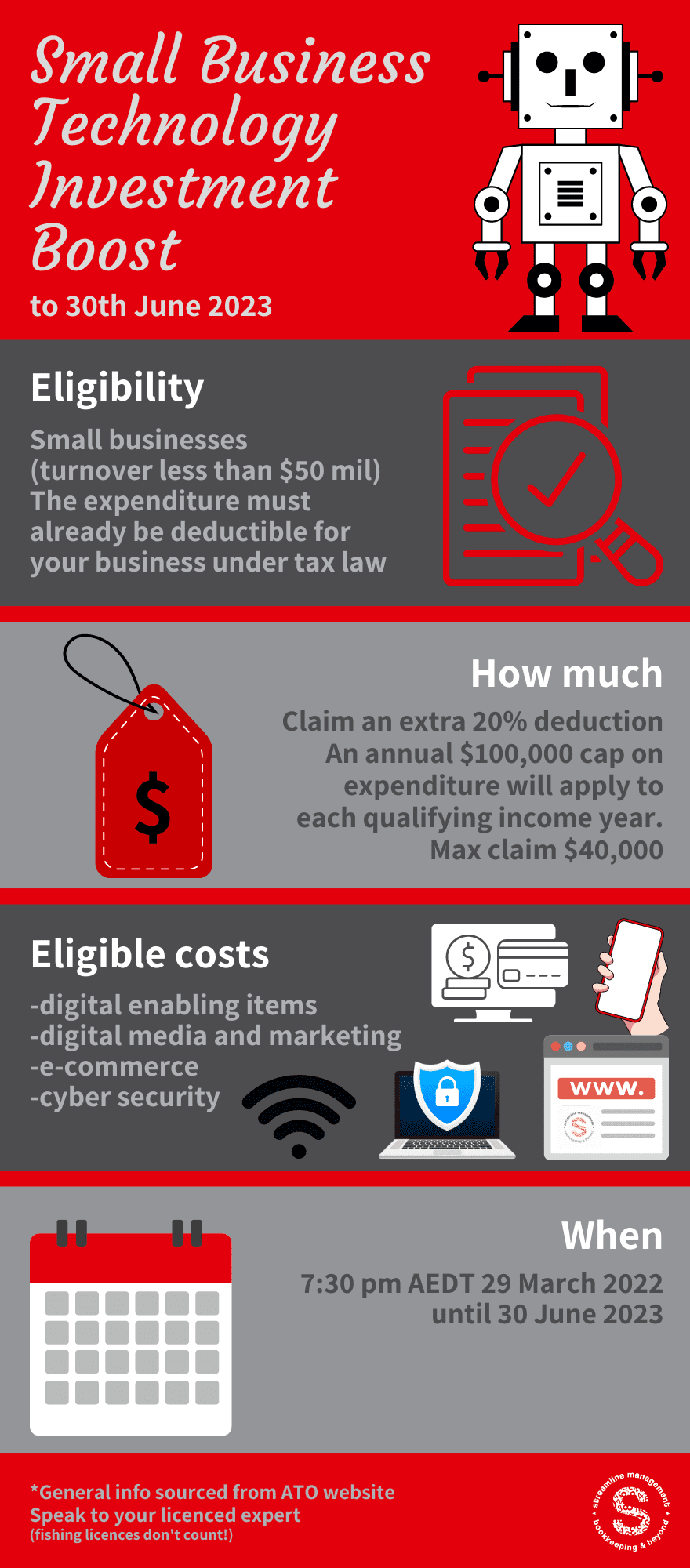

What is it?

An extra deduction above the actual cost of purchase. If you spend $1,000, you can claim $1,200 in your tax return. This lowers your taxable profit, so you pay less tax.

It does not mean a refund from the ATO.

What does the ATO mean by ‘technology’? its pretty broad.

This is what they say:

– digital enabling items – computer and telecommunications hardware and equipment, software, internet costs, systems and services that form and facilitate the use of computer networks

– digital media and marketing – audio and visual content that can be created, accessed, stored or viewed on digital devices, including web page design

– e-commerce – goods or services supporting digitally ordered or platform-enabled online transactions, portable payment devices, digital inventory management, subscriptions to cloud-based services, and advice on digital operations or digitising operations, such as advice about digital tools to support business continuity and growth

– cyber security – cyber security systems, backup management and monitoring services.

What should you do?

Review your expenses for the last 15 months and highlight subscription, website, gadget and marketing costs for your tax agent to claim in your 2022/23 tax return.

Fine print can be found here: https://www.ato.gov.au/Business/Income-and-deductions-for-business/Deductions/Small-business-technology-investment-boost/?=Redirected_Technologyboost