Watch out for the Fringe Benefits Tax (FBT) Grinch ruining the fun for everyone this Christmas!

Read on to find out about nice festive fun that may attract naughty surprise taxes.

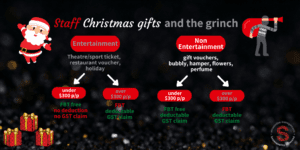

Gifts to Staff

Non-entertainment gifts to staff (such as Christmas hampers, bottles of alcohol, gift vouchers, pen sets etc), are tax deductible and you can claim GST credits, irrespective of cost. Note however that you can generally avoid paying FBT if you keep the gift under $300. If this threshold is exceeded, FBT will apply.

Entertainment gifts to staff (such as tickets to movies/theatre/amusement park/sporting events, holiday airline tickets etc) which are under $300 will not attract FBT, but are not income tax deductible, and you can not claim GST credits. If over $300, FBT will apply, but a tax deduction and GST credits can be claimed. With FBT rate sitting at 47%, the tax deduction and GST credits available is unlikely to provide a better tax outcome than avoiding FBT by keeping the gift under $300.

Gifts to Clients/Customers/Contractors/Suppliers

No FBT is payable, irrespective of the type of gift and irrespective of cost. However, where a gift constitutes entertainment, no GST or tax deduction can be claimed. Thus, at least from a tax standpoint, it’s better to provide non-entertainment gifts to clients (Christmas hampers, bottles of alcohol, gift vouchers, pen sets) and, in doing so, enjoy a tax deduction and GST credits.

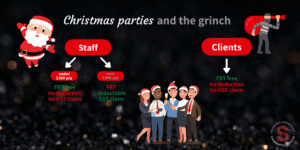

Parties

Instead of (or as well as) gifts, it’s quite common for employers to host a Christmas Party for their staff (often including spouses) at a restaurant.

Where this is the case, the total cost will generally be exempt from FBT provided the per-head cost (dinner and drinks) is kept to under $300 per person. This is known as the Minor Benefits Exemption. The downside of using the Minor Benefit Exemption is that the meal entertainment is not tax deductible, and nor can you claim a GST credit.

Speak to your accountant about the fine print and your specific circumstances.

*Information is courtesy of the Australian Bookkeepers Network.