July-September super contributions need to be received by your employees’ fund no later than 28th October (don’t forget to allow for processing time).

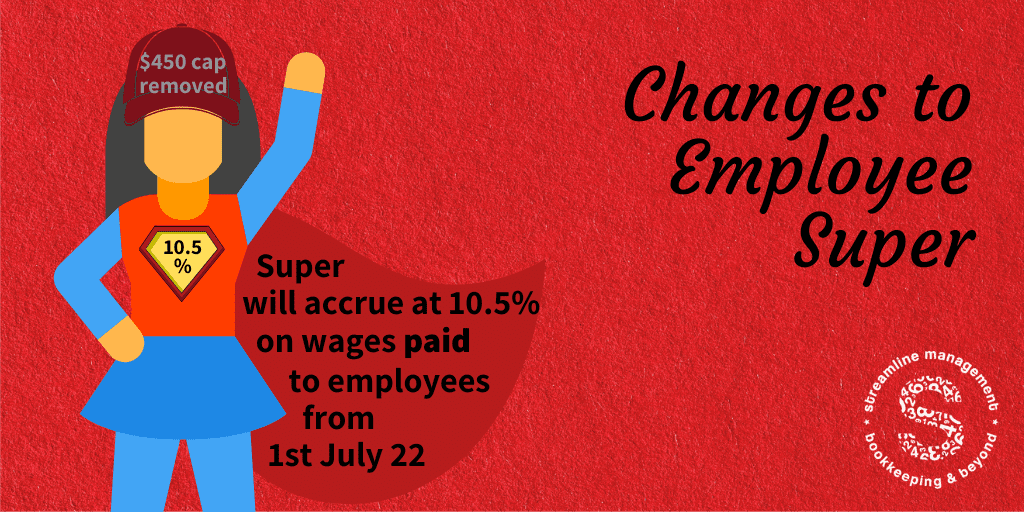

Make sure all super has been calculated at the 10.5% rate (even if part of the first July payment covered some of June).

The $450 minimum payment per month before super applies, is also no longer a thing.

Check your calculations to make sure all the new rules effective 1st July 2022 have been picked up before you make payment, so you don’t end up having to make a catchup payment (with heavy ATO penalties)