October IAS

October IAS is due – lodge and pay right now!

If you are unable to pay in full, contact the ATO to arrange a payment plan.

October IAS is due – lodge and pay right now!

If you are unable to pay in full, contact the ATO to arrange a payment plan.

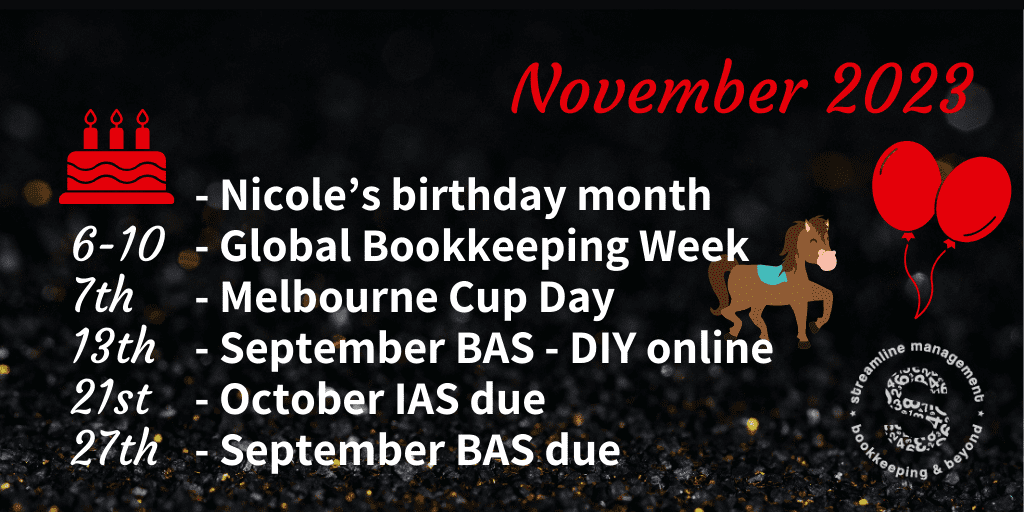

Have you marked all the key November dates in your calendar?

Get ready for celebrations and deadlines throughout the month.

This is not the time for last minute shenanigans, its time for action!

We have been beavering away on BAS preparations, make sure you to respond to our emails.

We need responses this week so we can lodge September quarter BAS by 25th November (or you risk being fined by the ATO).

The sooner we are able to prepare the BAS, the sooner you’ll be able to project your cashflow.

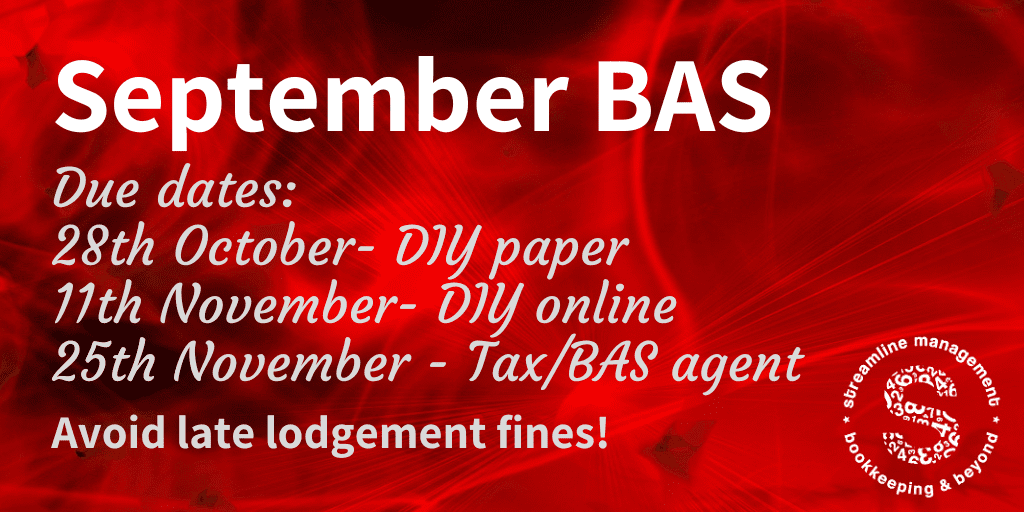

It’s time to start preparing your September BAS

Make sure everything is uploaded to ReceiptBank / Dext so we can get to work.

Please send bank statement pdfs so we can reconcile your bank accounts.

Using our BAS agent extension – the due date is 25th November.

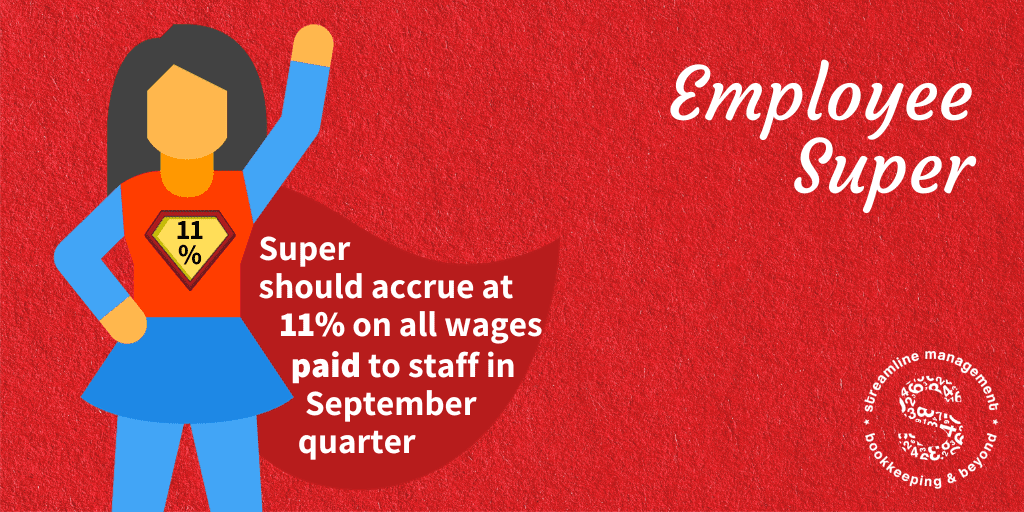

July-September super contributions, at the new rate of 11%, must be received (by fund) by 28th October.

Severe penalties will apply for late payments.

Don’t forget you need to lodge and pay your August IAS this Thursday 21st September (if you are a monthly lodger).

A nice quiet month. Take a breather.

Monthly lodgers will need to submit August IAS by 21st September, other than that, prepare for the end of another quarter.

If you have a construction, cleaning, IT, freight/courier or security business you need to report payments made for service to your subcontractors to the ATO.

This is one of the submissions that won’t cost you any money (assuming you lodge on time, otherwise expect a fine).

Construction is very broad – it includes engineering services, architects, communications construction, landscaping, retaining walls, swimming pool installation and wallpapering.

Need a hand to get the paperwork in by 28th August? Ask us to help.

It’s time to make sure your June quarter BAS has been lodged and paid (or a payment plan arranged).

Not in the mood? Late lodgement fines, defaulting on existing payment plans and your BAS agent is no longer allowed to file your payroll STP with their annual authority, its probably easier just to do a spot of adulting and lodge the thing.

Suspect you’re not really capable of nailing it? Get a tax or BAS agent to assist (you also get a big longer until the payment is due – win!).

to keep up with the news

Be the first to know about critical dates and important gossip!