March 2023 BAS due today!

Make sure you’ve lodged or authorised us to lodge on your behalf.

Payment is also due today – can’t pay in full? Make a payment plan.

Not ready yet? Stop mucking around and get your butt into gear!

Make sure you’ve lodged or authorised us to lodge on your behalf.

Payment is also due today – can’t pay in full? Make a payment plan.

Not ready yet? Stop mucking around and get your butt into gear!

Don’t get caught up in the hype. Making big purchases for tax benefits may not benefit your business. There, we said it.

Read the fine print and understand the rules (or speak to someone who is licenced to explain the rules to you).

Don’t forget the salesperson would love to meet sales targets and get paid a big fat commission, but they are not licenced to give you tax advice.

Taking on lots of finance to shaft the ATO could cost you a lot more than you think!

You may have seen news stories about ‘improvements’ to super starting in 2026. Its not yet law, so don’t get ahead of yourself.

Assuming the bill passes….

From 2026 you will need to pay super on behalf of your employees each time you pay their wages. Payment frequency will change from quarterly to weekly/fortnightly/monthly (or a combination). Payments will be due much sooner than you have been used to.

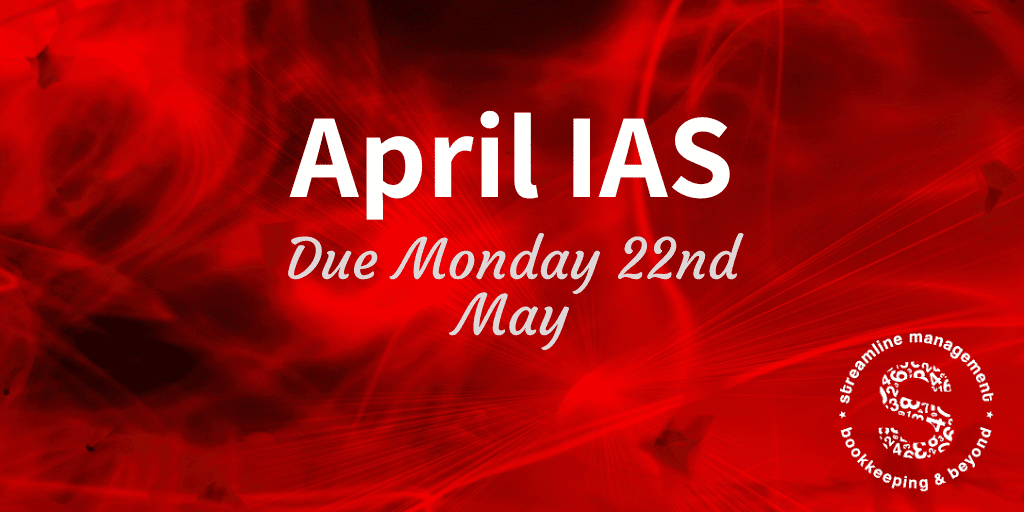

If you report monthly to the ATO, you’ll need to ldoge and pay your April IAS by Monday 22nd May.

Are you using your super powers to make the world a better place for your team in their retirement?

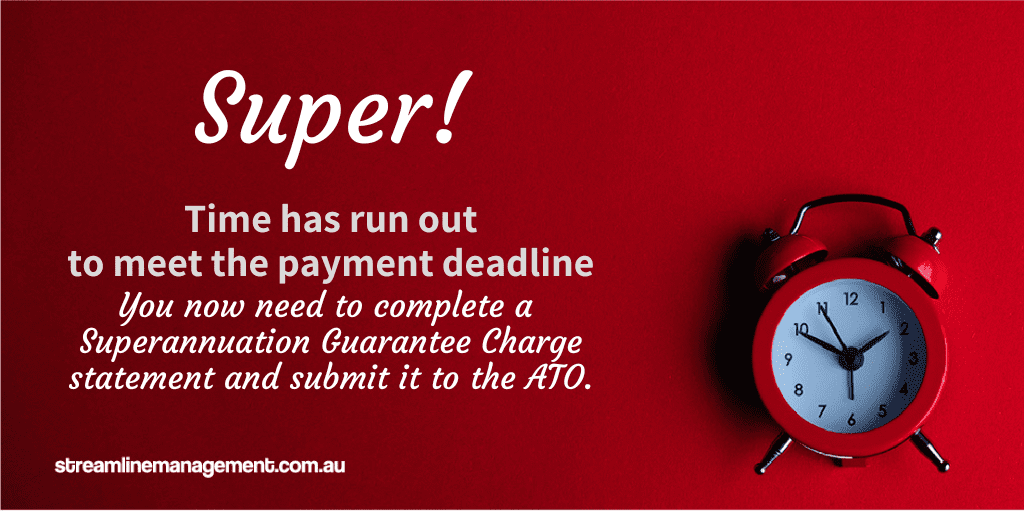

January – March super contributions need to be in your employees superannuation fund accounts today, what happens if that deadline hasn’t been met?

Penalties. Harsh Penalties. Business Kryptonite.

Be a super hero for your employees and make sure superannuation payments are made on time!

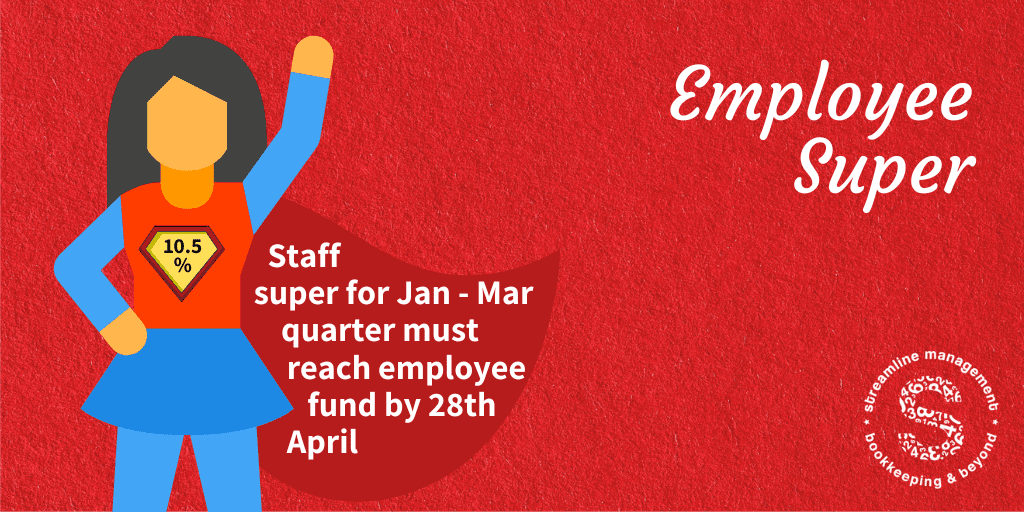

Authorise staff super NOW!

The funds need to arrive and be receipted into employee accounts on or before 28th April to ensure compliance.

Non compliance means the expense is no longer a tax deduction for your business, and you as a director of the firm, become personally liable.

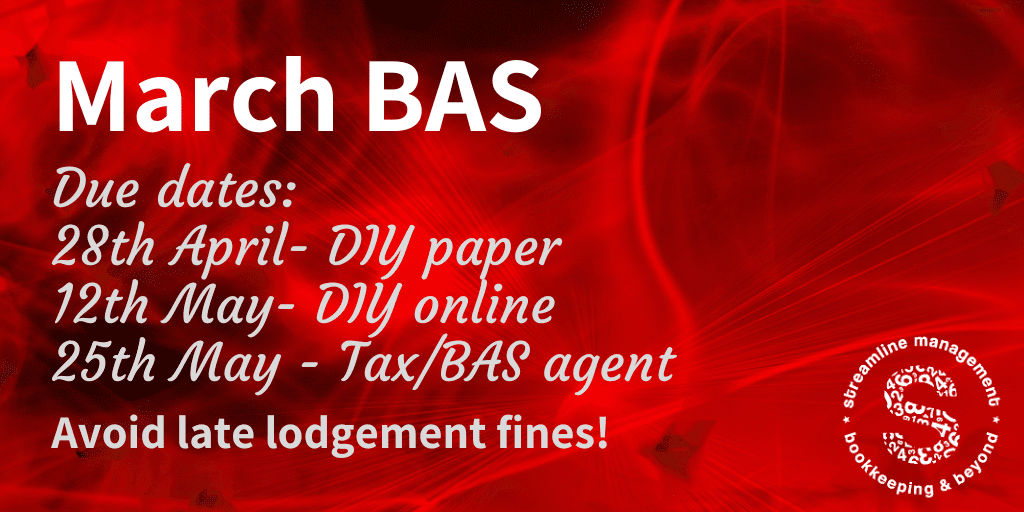

Using our BAS agent extension – the due date is 25th May. However we need our clients to provide all data to us by 30th April so we can review, amend and prepare your March BAS for lodgement by the due date.

If you DIY your BAS lodgements, your due date will be earlier. You really need to act now!

Staff super contributions for wages paid between January and March are due soon.

You’ll need to approve xero super for payment by 20th April to make sure it can fly through cyber space and land in your employees accounts on or before 28th April.

Harsh penalties apply to late payments.

Awards are not changing, however gross wages need to be broken down into the individual components. You need to display all allowances separately from the hourly rate you pay your team. (make sure you’re actually meeting minimum payrates!)

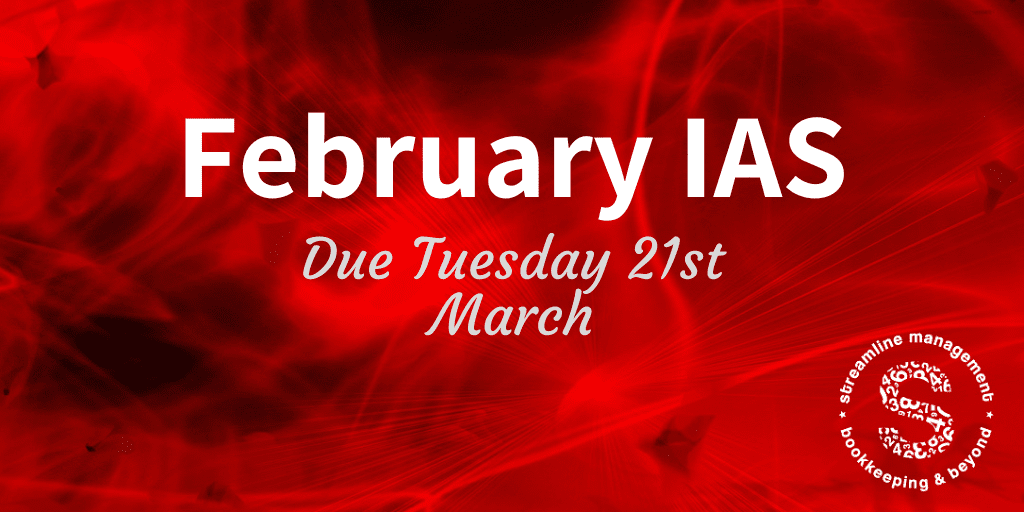

Set some money aside, for monthly lodgers, your February IAS is due on 21st March.

Watch out for late lodgement fines – it could be up to $2,750!

to keep up with the news

Be the first to know about critical dates and important gossip!