Its time to get started on your June BAS, If you are one of our fabulous clients, make sure everything is uploaded to ReceiptBank / Dext so we can get to work.

Please send bank statement pdfs.

Any remaining unpaid April-June super contributions must

be received (by fund) by 28th July.

If you have any concerns about being able to make this payment on time,

speak to your expert now to discuss options.

Penalties will apply for late payments.

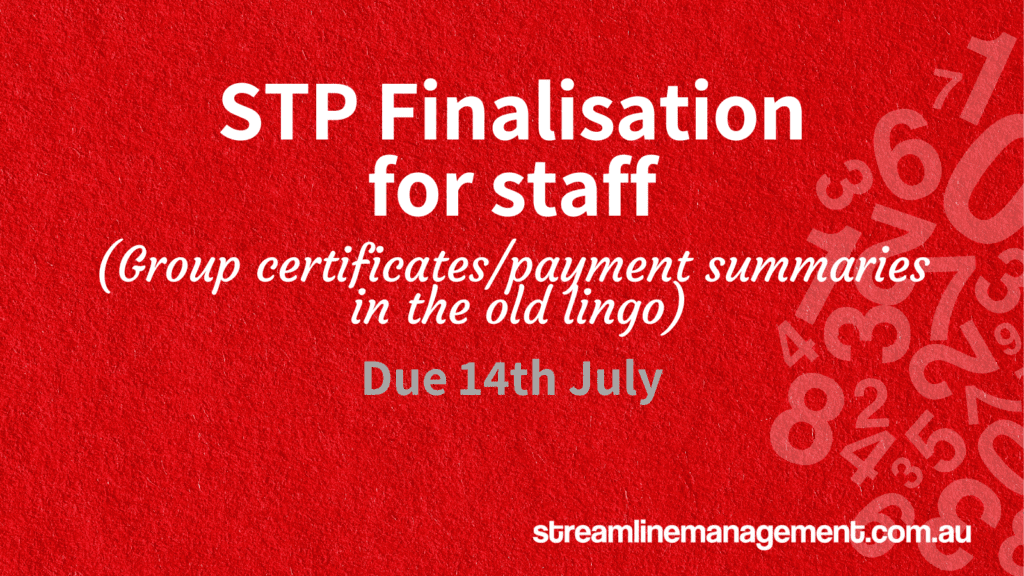

Annual ‘STP Finalisation’ to the ATO by 14th July.

(This replaces providing Payment Summaries/Group Certificates to your staff

and submitting the Payment Summary Annual Report (PSAR) to the ATO.)

Staff will not be receiving any documentation, they will be able to access details in their MyGov account.

Cheers to us. Cheers to you!

Thank you for being a part of our community.

#25YearsAndCounting

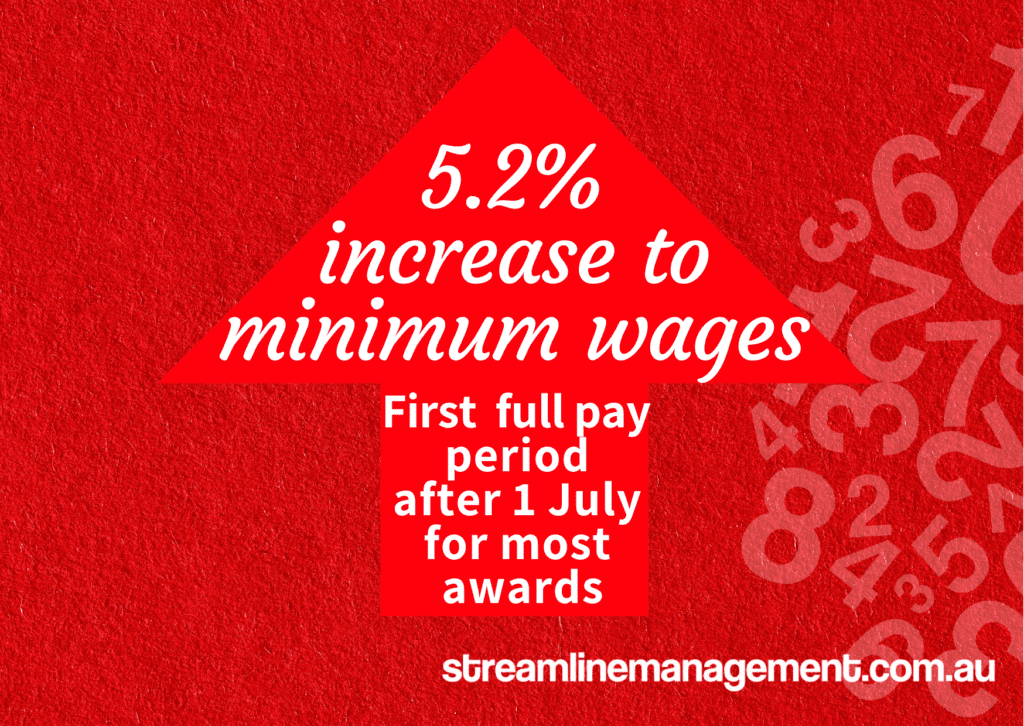

Some awards will get a minimum wage increase from the first full pay period on or after 1 July 2022, while others will get one from the first full pay period on or after 1 October 2022.

Are you aware of what business insurance you might need?

Click through for suggestions and links

We will need to file an annual ‘STP Finalisation’ to the ATO by 14th July.

(This replaces providing Payment Summaries/Group Certificates to your staff and submitting the Payment Summary Annual Report (PSAR) to the ATO.)

Small Business Fees And Charges Rebate of up to $3,000

You may be eligible to claim back your company vehicle registration among other charges

The apply by 24th June (tomorrow)

claims accepted until 30 June 2022.

to keep up with the news

Be the first to know about critical dates and important gossip!