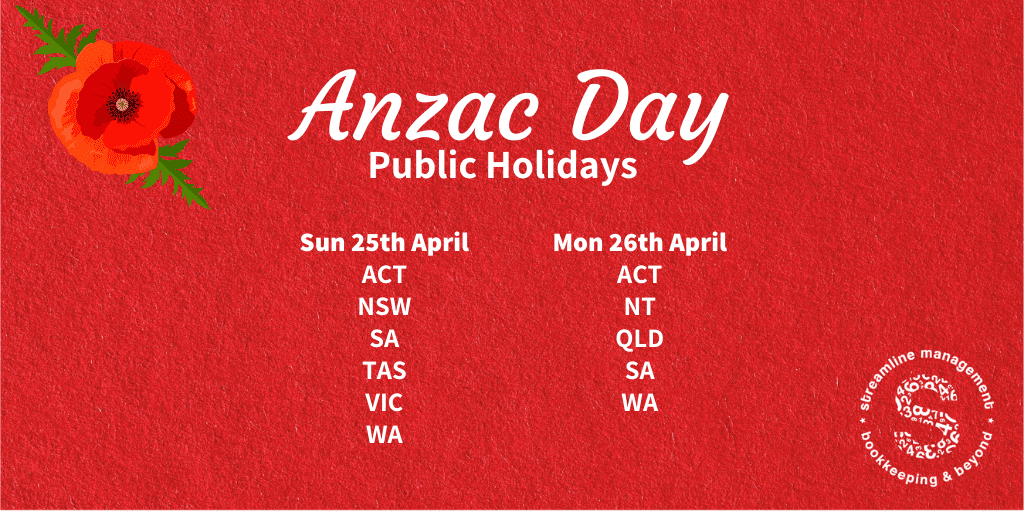

Anzac Day Public Holidays 2021

Anzac Day is coming up, are you aware of which days are considered public holidays in your state?

According to fairwork –

3 states have declared 2 public holidays,

2 states have moved to Monday and

3 are on the actual day.