Leave The Office Early Day

Are you still here?

If you’ve still got too much crap to do, it sounds like time to delegate.

Well maybe start that tomorrow.

Go home! Call us tomorrow for help (we’re going home early today)

Are you still here?

If you’ve still got too much crap to do, it sounds like time to delegate.

Well maybe start that tomorrow.

Go home! Call us tomorrow for help (we’re going home early today)

Get your date file up to date, process everything still outstanding so you know exactly where you stand.

There is not a lot of benefit spending more money, if you are already in a loss position. If you are in a surprise profit situation, it would be good to know before its too late to take action.

Watch out for tax advice parrots!

So far we haven’t met a licenced parrot, have you?

Speaking to your licenced tax advisor about your situation is the only sensible way to manage your tax position.

Parrots are known for flying in, making a lot of noise, crapping on everything and flying off again. Watch out for parrots this end of financial year!

Superannuation paid on behalf of employees (including owners/directors) will increase to 10% for all wages paid (bank transfer) on or after 1st July 2021.

Today is the last possible day for on time lodgement of your March BAS using the agent extension. Any March BAS lodged after today risks a late lodgement fine.

If your March BAS is ready – Lodge!

If you cannot pay in full – arrange a payment plan with the ATO.

Even if you can’t pay the BAS, it is important to lodge on time – late lodgement could result in fines. And those fines escalate for habitual offenders.

Payment plans can be created using an automated phone service – you don’t have to explain yourself to a human.

Lodge now!

What time is it?

It’s 5 minutes to midnight!

If your agent lodges on your behalf – the March quarter BAS is due 26th May – will you be ready?

If you still need to send missing source documents or respond to questions – act now!

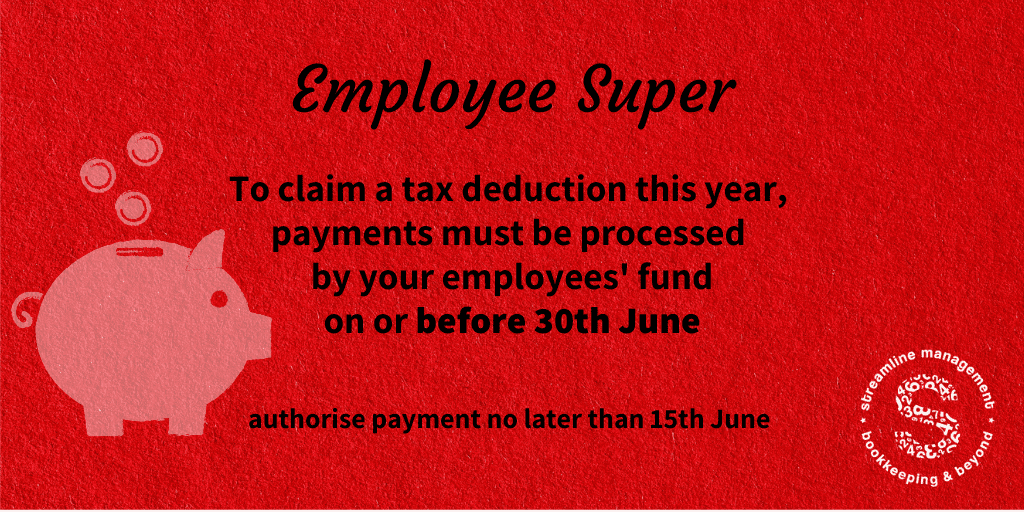

To qualify for a tax deduction in the 2021 financial year,

or

if you are managing your super cap, super contributions must be received (by fund) by 30th June

The usual deadline of 28th July still applies for June quarter super if you are not chasing the tax deduction or maximising your super cap.

What if you’ve lost your mojo?

If you are a small business owner, you’re probably fully aware that DIY bookkeeping causes stress!

Who can you speak to about your business? Your bookkeeper knows all about your business and probably a fair bit about you too! Ask questions, discuss your vision and work together to find better ways to do things. BAS agents work with other businesses with similar issues, they’ve seen the good, the bad & the ugly. Take the time for a chat before small business stress overwhelms you.

If you are upgrading your phone to something a little more modern – you’ll need to transfer your 2 step authenticator BEFORE you lock yourself out of all your cloud apps!

Ask us for help so you don’t temporarily lose access to xero.

to keep up with the news

Be the first to know about critical dates and important gossip!