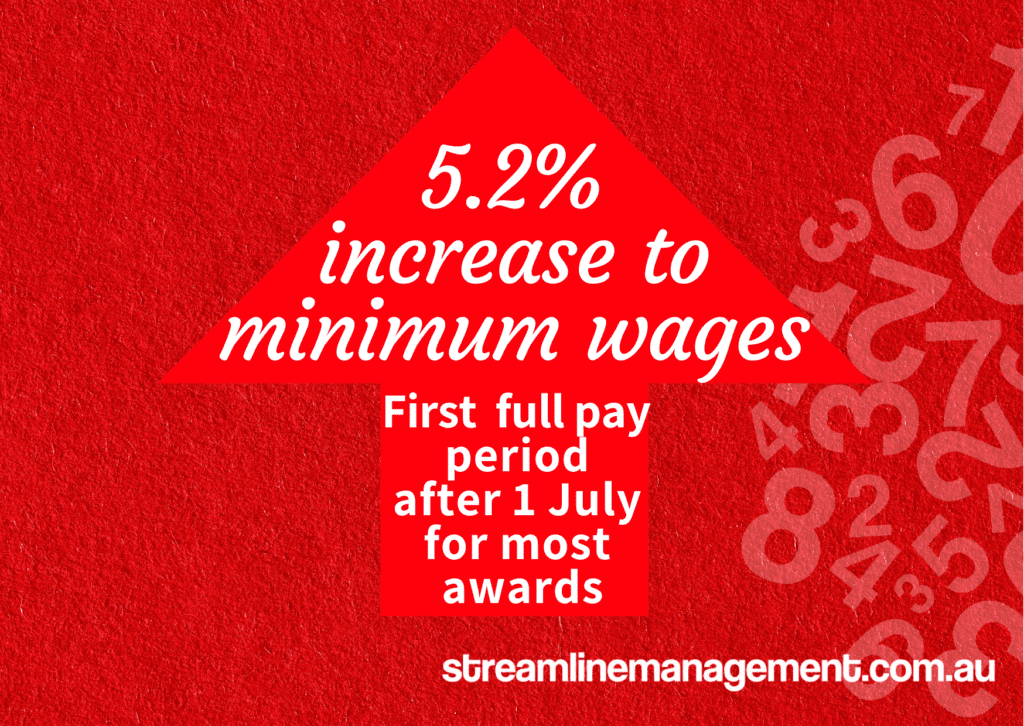

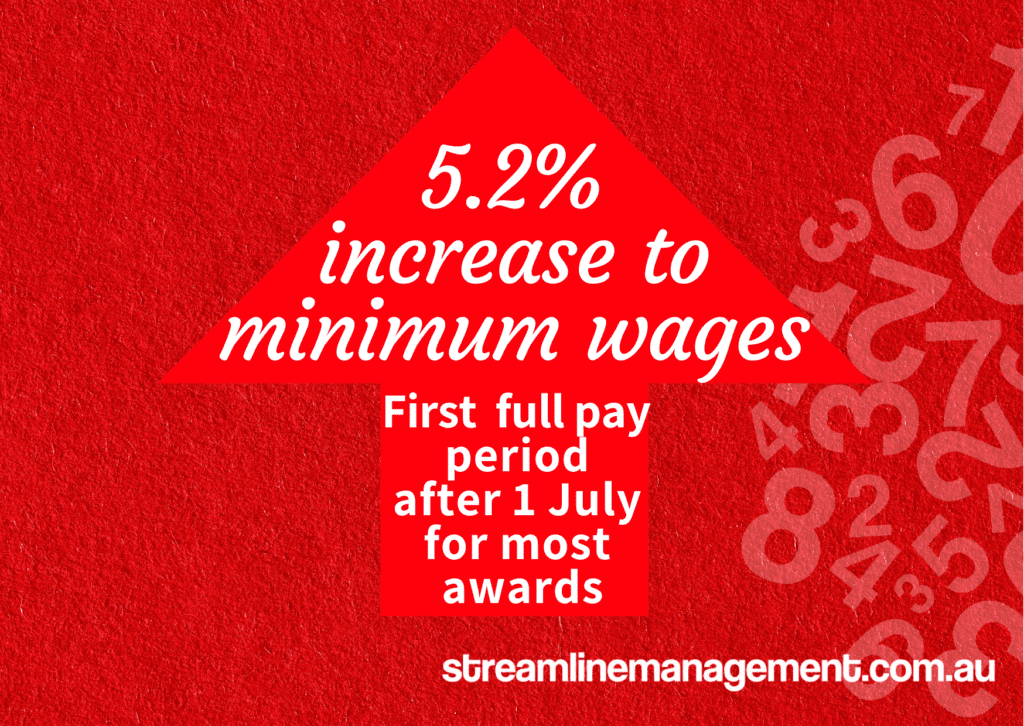

Increases to minimum wages

Some awards will get a minimum wage increase from the first full pay period on or after 1 July 2022, while others will get one from the first full pay period on or after 1 October 2022.

Some awards will get a minimum wage increase from the first full pay period on or after 1 July 2022, while others will get one from the first full pay period on or after 1 October 2022.

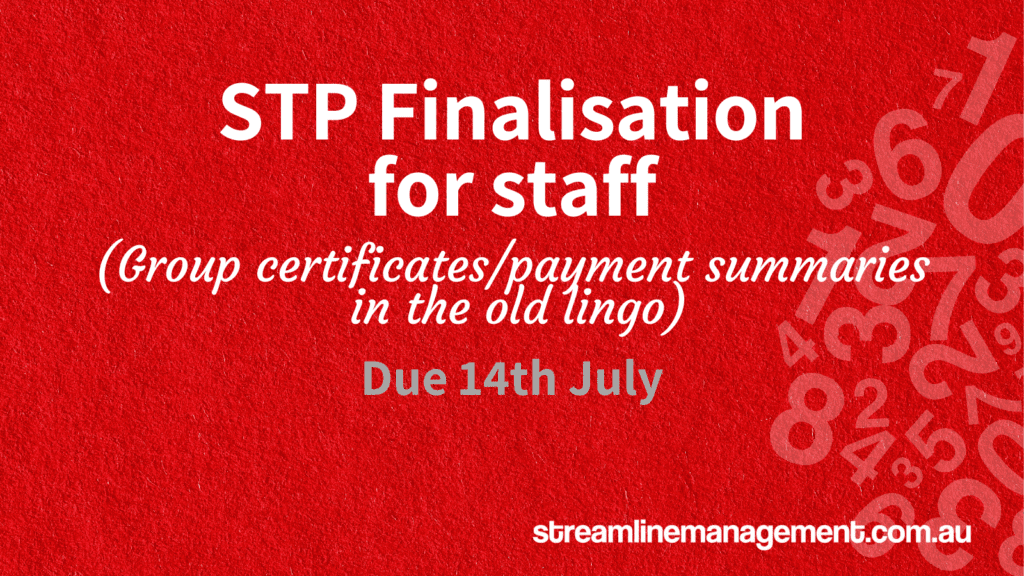

We will need to file an annual ‘STP Finalisation’ to the ATO by 14th July.

(This replaces providing Payment Summaries/Group Certificates to your staff and submitting the Payment Summary Annual Report (PSAR) to the ATO.)

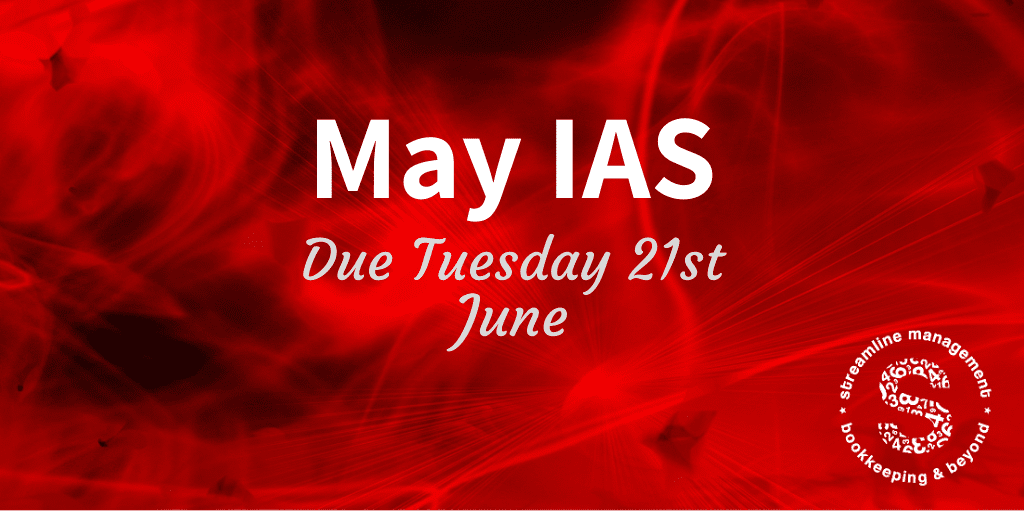

Hey monthly lodgers, if you haven’t already, remember to e-sign your May IAS to avoid any late lodgment fines. Best to make the payment too!

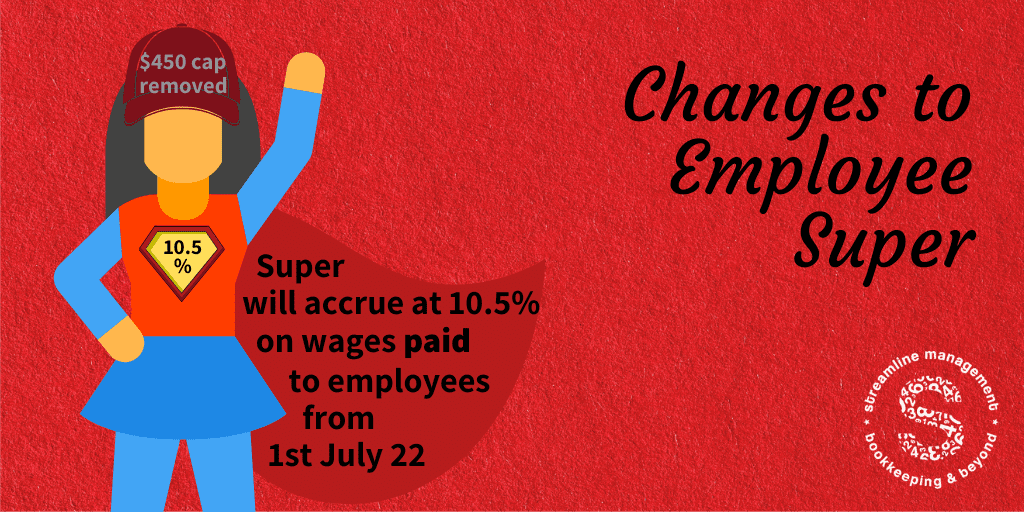

Superannuation paid on behalf of ALL employees (including owners/directors) will increase to 10.5% for wages paid (bank transfer) on or after 1st July 2022.

The $450 per month threshold will no longer be applicable.

Last chance!

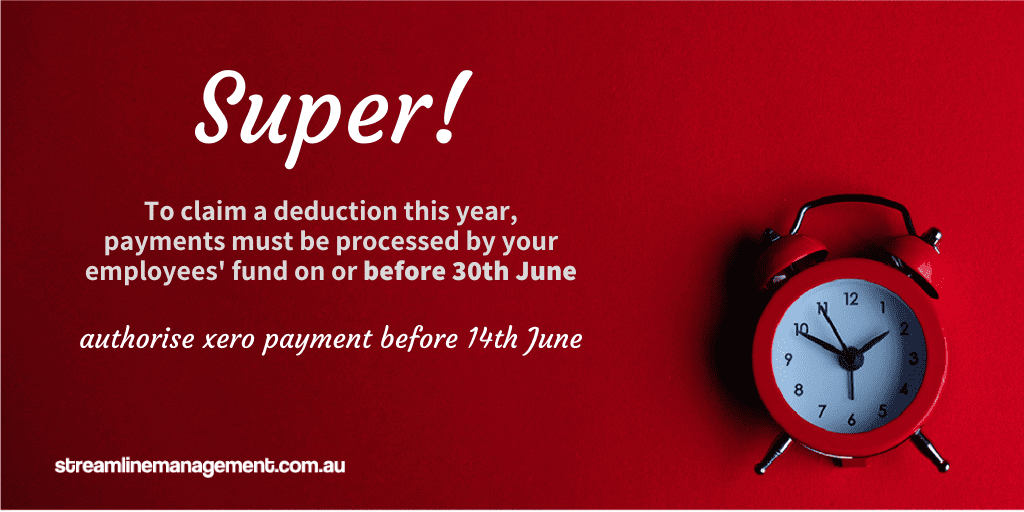

Approve super in Xero by 2pm today to ensure payment is received by 30th June.

(If you’re not chasing the earlier tax deduction, then the usual deadline of 28th July still applies.)

Single Touch Payroll (STP) 2 is coming

What do you need to do?

Nothing right now, your accounting software will do most of the work in the background – Xero has an extension to December 2022, so there is plenty of time to transition.

Sit Tight Please (STP).

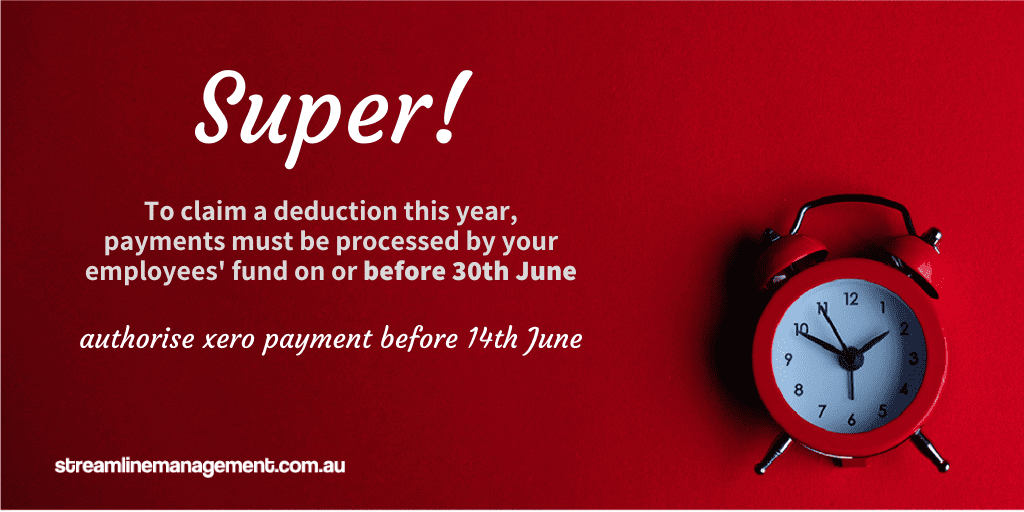

To qualify for a tax deduction in the 2022 financial year, or if you are managing your super cap, super contributions must be received (by fund) by 30th June.

Payments need to be authorised before 14th June to meet the deadline.

The usual final deadline of 28th July still applies if you decide not to pay early.

If you are trying to make the most of super caps – you need to be aware of what a valid salary sacrifice looks like.

Working from home is now kinda normal, but as an employer what do you need to be aware of?

What are you responsible for? How do you protect your team? What support or equipment might they need?

Your responsibilities to protect your team still apply, even if you can’t see them.

See what Safe Work Australia says you need to be aware of.

It’s a bird, its a plane, its a person planning for their future needs!

Are you employing super heroes (who want to put away a bit extra for their retirement)?

Salary sacrificing wages into super can help employees save faster than a speeding locamotive, but as an employer, you need to make sure you have all the right paperwork.

Wearing your undies on the outside of tights is all well and good, leaping tall buildings in a single bound has OH&S issues, being your own retirement hero is a super idea!

Don’t forget to record when your staff take annual or sick leave to make sure leave balances are up to date.

Need help to make sure your records are correct? Ask an expert to help.

to keep up with the news

Be the first to know about critical dates and important gossip!