Streamline Management News

* This is generic info to give you a few pointers and should never be relied on as specific accounting advice.

Contact your expert (not your mates at a BBQ or the guy trying to sell you something) to discuss your situation.

Work Your Proper Hours Day

Are your team working their proper hours? Do you know what the proper hours are?

Fairwork says:

Maximum weekly hours form part of the National Employment Standards (NES). The NES apply to all employees covered by the national workplace relations system, regardless of any award, agreement or contract.

– maximum ordinary hours that can be worked in a day, week, fortnight or month

– minimum ordinary hours that can be worked in a day

– times of the day that ordinary hours can be worked this is called the spread of hours (for example, between 7am and 7pm).

The ‘spread of hours’ may catch you out if you allow your team to work flexible hours (after they’ve had dinner) – they still need to fit inside the spread of hours or you could be up for overtime rates!

Reconnect your Amex bankfeed – now!

Existing Amex bank feeds will stop working on 28th February – act now to prevent missing data!

Please see notice and instruction from Xero

January IAS deadline

Make sure you’ve lodged your January IAS if you report to the ATO monthly.

You also need to make payment or arrange a payment plan.

(Don’t forget the December BAS is due in a week)

Dext Insight Series Upcoming Webinar: Automating your workflows

Bookkeepers and accountants looking to reduce time spent on manual tasks can join Nicole on Thursday 15th February 2024 to see how you can ‘streamline’ your workflows.

It promises to be insightful!

Employees vs Contractors – ATO update

On 6th December 2023 the ATO released a new Tax Ruling in response to a High Court decision about classifying workers.

We’ve trawled through various ATO pages and summarised it for you with links.

To work out if your worker is an employee or contractor, you need to determine whether your worker is serving in your business or is running their own business. You do this by reviewing the legal rights and obligations in the contract you entered into with your worker.

– Ask for help if you need it!

The Xero American Express feed is changing

American Express bankfeeds are getting an upgrade!

American Express is introducing a new direct bank feed allowing easier setup and improving access to reliable transaction data. Please reconnect your American Express feeds now, but no later than 28 February 2024. This will ensure their transactions continue to flow into Xero. After this date, existing feeds will no longer be supported and will stop importing transactions.

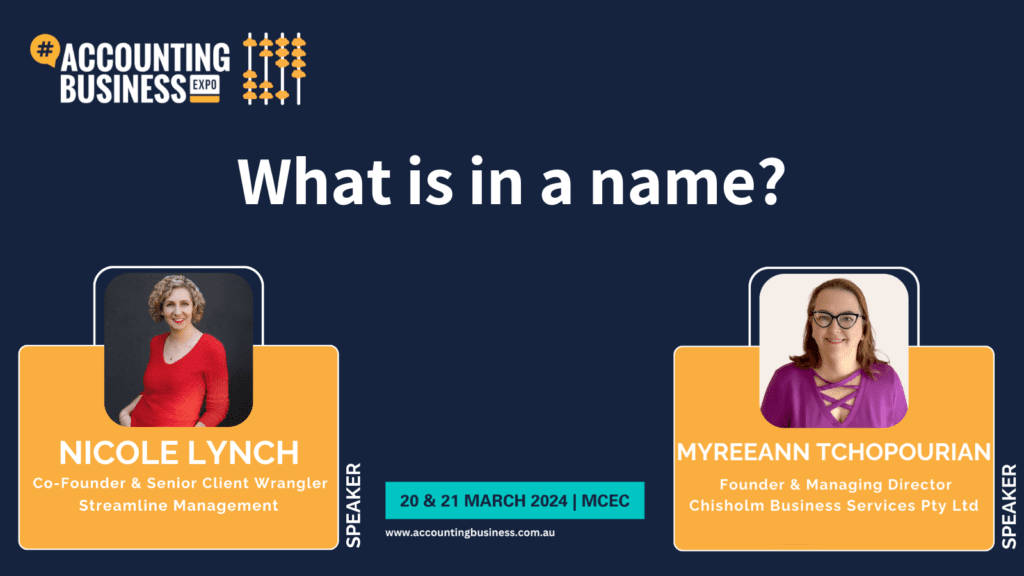

Accounting Business Expo – What is in a name

Join Nicole & Myreeann at ABE (Accounting Business Expo) in Melbourne 20 – 21st March 2024!

They will be feature on the bookkeeping stage discussing: What is in a name?

Great if you are just starting out in business or thinking of a rebrand.

Come along to snaffle hours of free CPE, swag & product demos, and catch up with your industry peers.

Change Your Password Day

Australian Cyber Security Centre says:

Passwords are passé. It’s time to use passphrases instead.

A passphrase uses four or more random words as your password. For example, ‘crystal onion clay pretzel’ or ‘red house sky train’.

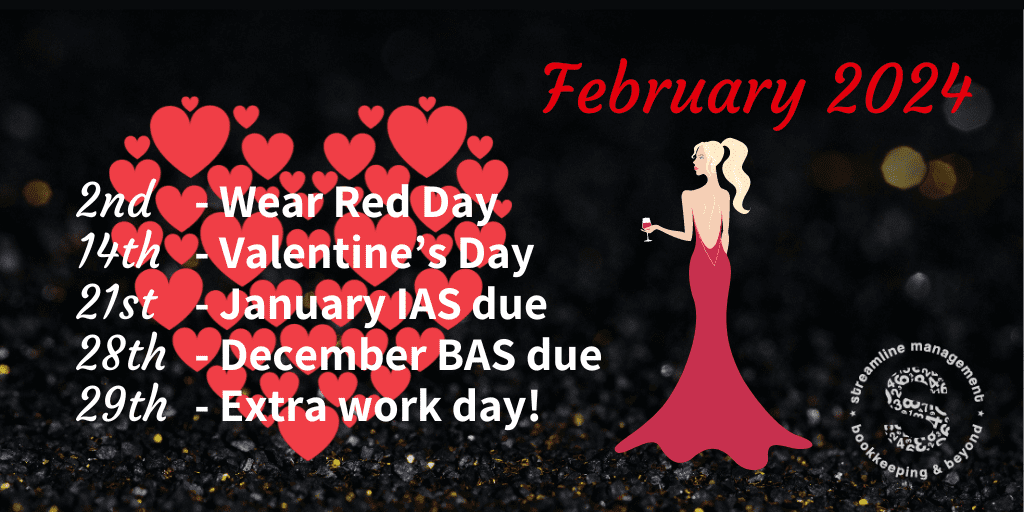

February 2024

Mark up your diary with important February details.

Wear Red on Friday 2nd February – you can use it as a warm up for Valentines day on the 14th!

ATO deadlines – you can’t avoid those!

And finish off the month with a bonus work day to catch up on that to do list? Score!

Back to school, back to work!

Don’t forget to keep staff take annual and/or sick leave balances up to date.

FOLLOW US

to keep up with the news

Subscribe to our Newsletter

Be the first to know about critical dates and important gossip!