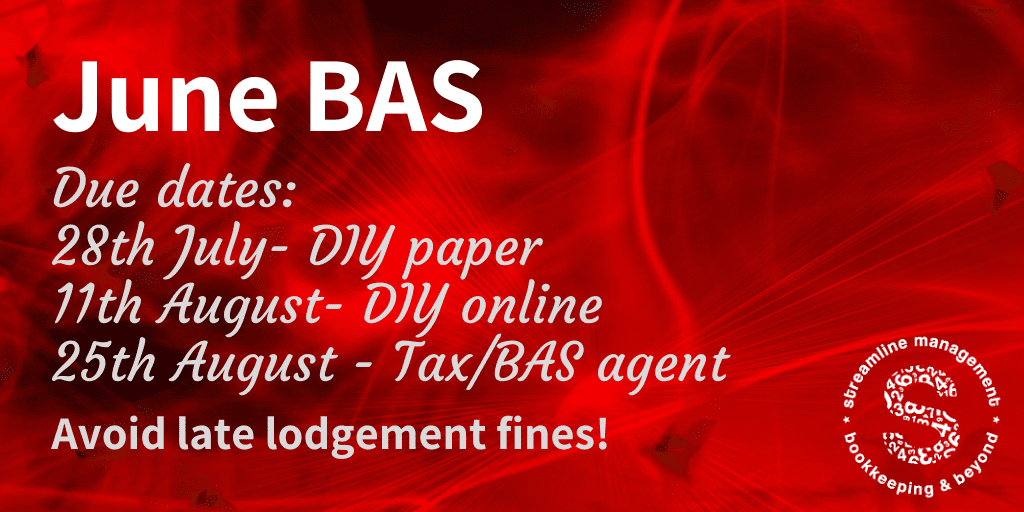

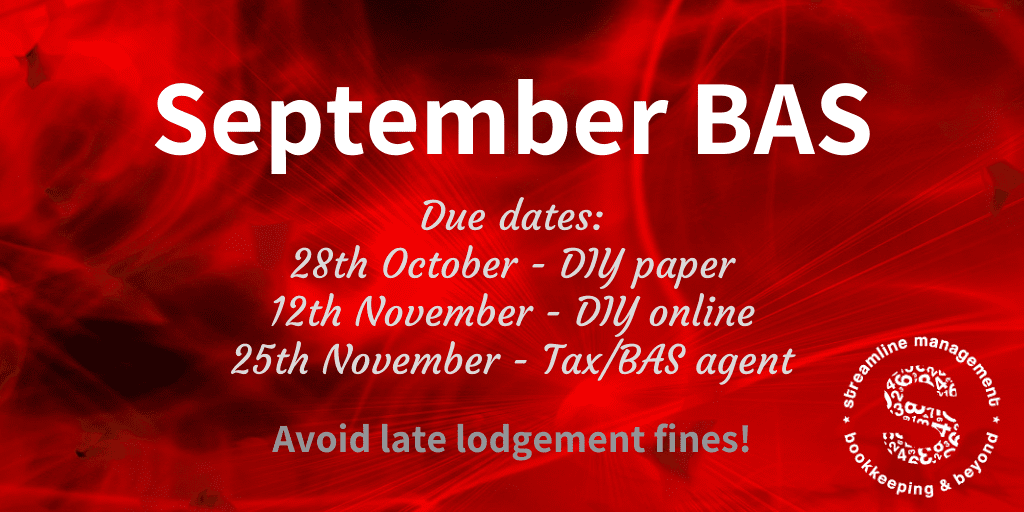

September BAS due dates

It’s time to start preparing your September BAS

If you’ve decided to DIY your BAS, there are 2 possible due dates:

– 28th October if you lodge using the pinkish paper form

– 12th November if you lodge online in the business portal

Using our BAS agent extension – the due date is 25th November