Fashion Day in your family business

Do several members of your family have the same taste in work clothes because you work together in a family business?

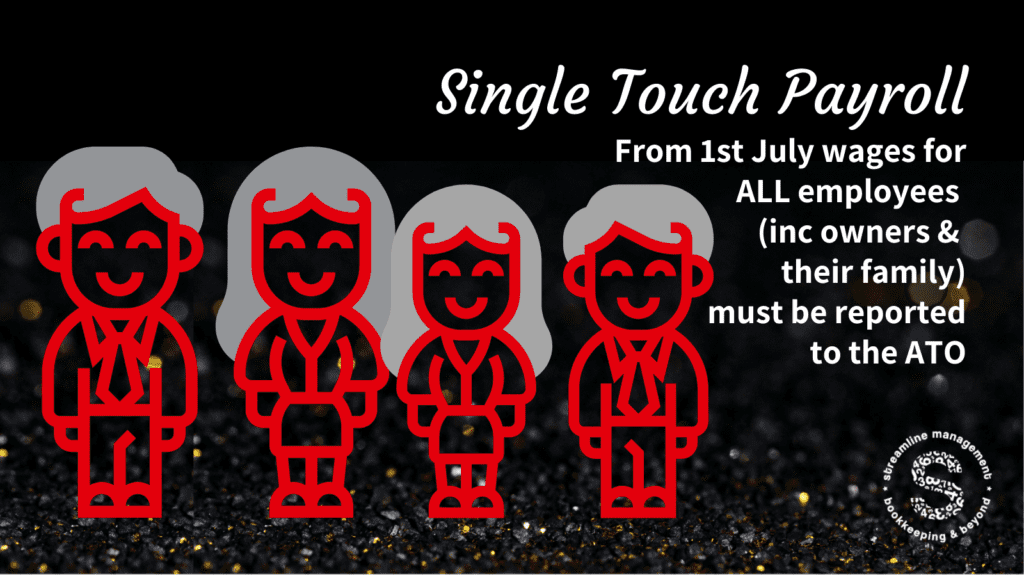

From 1st July 2021 the exemption for businesses to regularly report wages for closely held employees (owners/directors/shareholders & their family members) is being removed.

Single Touch Payroll (STP) reporting for closely held employees must be at least quarterly, declaring a wage as at 30th June each year will no longer be acceptable.