Hunt for Happiness Week

Hello.

Is it me you’re looking for?

If you’re spending this week hunting for happiness and you discover handing over the books to experts gets you a little closer – ask us about being part of your support party.

Hello.

Is it me you’re looking for?

If you’re spending this week hunting for happiness and you discover handing over the books to experts gets you a little closer – ask us about being part of your support party.

Late lodgement

– could result in fines

– void any payment plan you have in place

– void any annual authority to file STP

act now!

Is your resolution for 2022 to get your cash ducks in a row?

Do you have to get out the life preserver when big bills are due to be paid?

If 2022 is the year you want your cash duck to float gently on top of your bank balance – sing out for a demo

So here we are at day 12 of 2022 – are you managing to stay on track? Did you bother with resolutions?

Have you decided to find a better balance with your personal life? That you need to spend less time in your business?

Resolving to get a BAS agent (licenced bookkeeper) on your team could be the best decision you make all year!

Reach out if 2022 is the year you get help in your business.

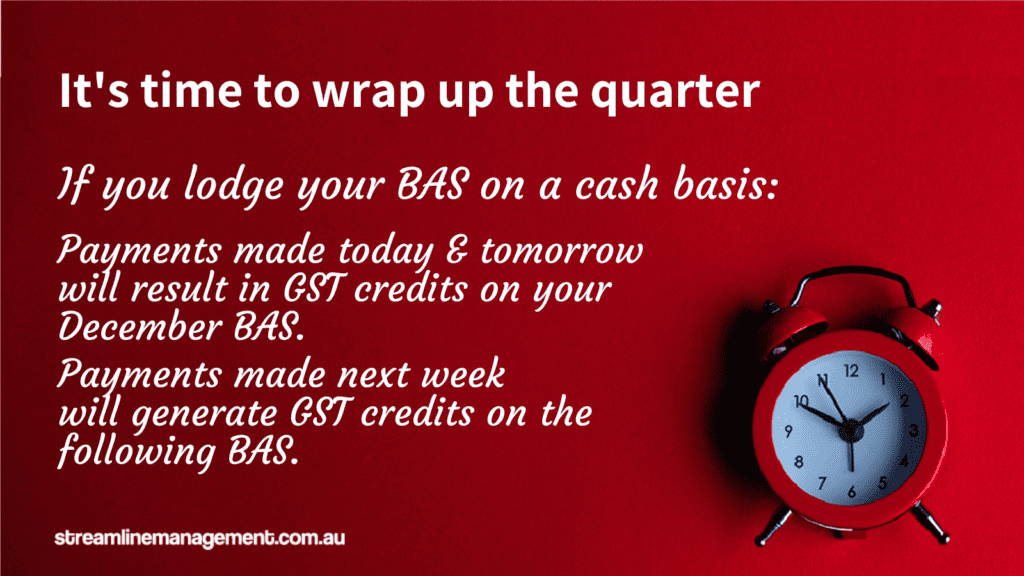

Here we are at the end of another quarter.

Payments made to suppliers today & tomorrow result in GST credits on December BAS for cash reporters.

For accrual reporters, payments made today & tomorrow result in happy suppliers!

So you’ve submitted your final JobSaver or Micro Business Grant.

But have you looked at the small business fees and charges rebate?

If you are a sole trader or the owner of a small business in NSW, you may be eligible for the Small Business Fees And Charges Rebate of up to $2,000.

Don’t let an unexpected tax bill spoil Christmas.

ATO says: Fringe benefits tax (FBT) is paid by employers on certain benefits they provide to their employees

Entertainment is the most common type of FBT we see.

What is considered entertainment? It includes events and/or gifts

Single Touch Payroll 2.0 is coming in 2022

What does that mean for your business?

The ATO wants you to report wages in a more granular way, gross wages will be broken down into the various components

What do you need to do?

Nothing right now, your accounting software will do most of the work in the background, so Sit Tight Please.

to keep up with the news

Be the first to know about critical dates and important gossip!