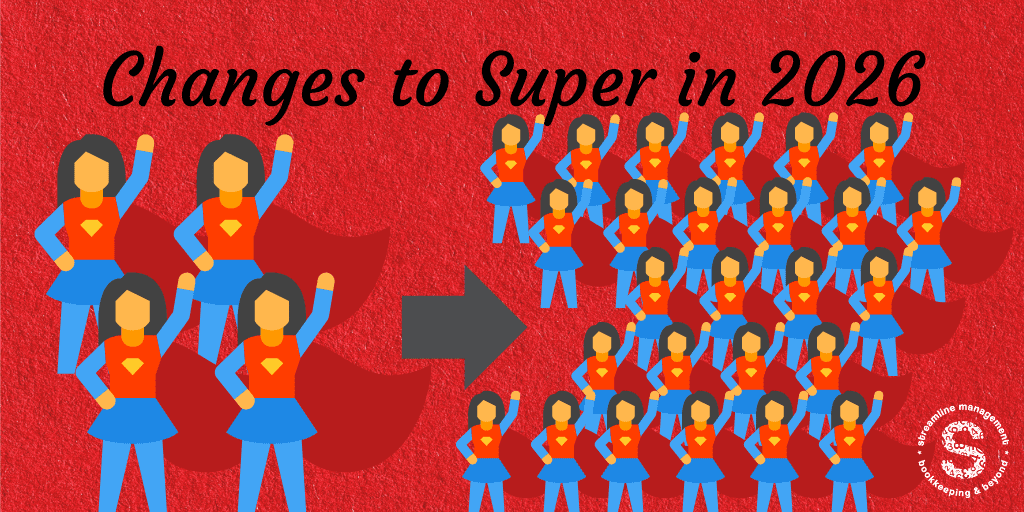

Mooted changes to super

You may have seen news stories about ‘improvements’ to super starting in 2026. Its not yet law, so don’t get ahead of yourself.

Assuming the bill passes….

From 2026 you will need to pay super on behalf of your employees each time you pay their wages. Payment frequency will change from quarterly to weekly/fortnightly/monthly (or a combination). Payments will be due much sooner than you have been used to.