Streamline Management News

* This is generic info to give you a few pointers and should never be relied on as specific accounting advice.

Contact your expert (not your mates at a BBQ or the guy trying to sell you something) to discuss your situation.

Improve Your Home Office Week – what expenses can you claim?

Are you thinking of making improvements to your home office?

Do you know what you can claim?

ATO says: If you operate some or all of your business from your home, you may be able to claim tax deductions for home-based business expenses

(check the fine print!)

Own Business Day – Director Fees

You can only claim deductions for payments you make to your workers (employees or contractors) from 1 July 2019 where you have complied with the pay as you go (PAYG) withholding AND reporting obligations for that payment.

Any payments you make to a worker where you haven’t withheld or reported the PAYG amounts are called non-compliant payments.

If you don’t comply with your PAYG withholding and reporting obligations for a payment, you may:

– lose your deduction for that payment

– face existing penalties that apply for failure to withhold and report amounts under the PAYG withholding system.

October Cyber Security Awareness Month

The Optus debacle has reminded us that we need to do all we can do to protect the identity of our client and their staff.

The easiest place to start is not to send any sensitive info by email – if any part of the email chain gets hacked, that info could get into the wrong hands.

Sing out if you have any questions about how we can help you keep your employees top secret info out of the hands of baddies.

Sustainability advice for businesses in Sydney’s North Shore region

Better Business Partnership aims to help reduce energy and water bills of businesses in Sydney’s North Shore region.

Apply now

500 Blog posts!

Can you believe it???? 500 informative tidbits under our belt!

Did you know Xbert included us in their 10 Australian bookkeeping blogs you need to read list

They said: They’re straight-shooters, love to have a laugh and have plenty of expertise to share.

If you enjoy a giggle while you’re learning, then this blog is your go-to!

#TootYourFluteDay

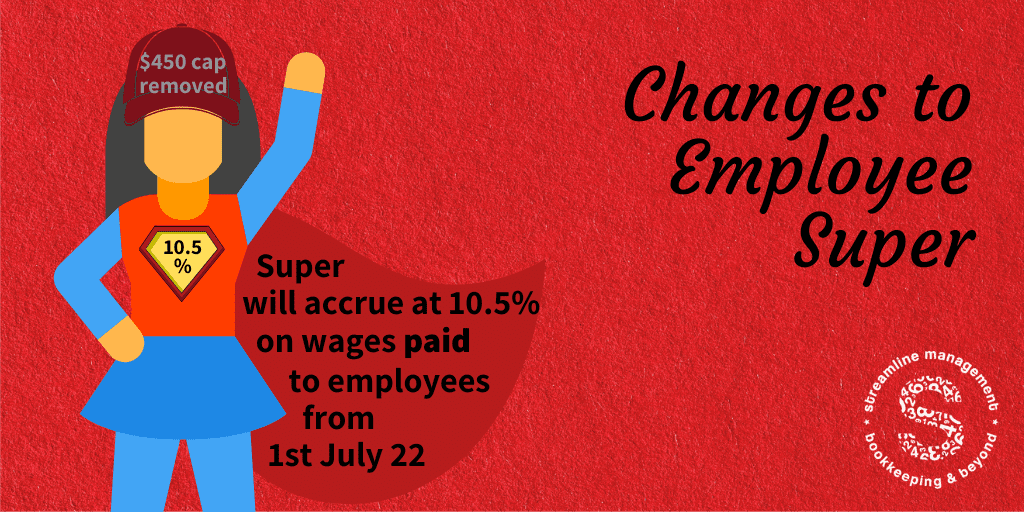

Time to pay super for your employees

July-September super contributions need to be received by your employees’ fund no later than 28th October (don’t forget to allow for processing time).

Check your calculations to make sure all the new rules effective 1st July 2022 have been picked up before you make payment, so you don’t end up having to make a catchup payment (with heavy ATO penalties)

Love Note Day (testimonials)

What is the best business love note you’ve received?

We’ll go first:

I fully recommend Streamline on the following basis:

-Both Monika & Nicole are super experts on Xero

-Payroll proficient & Single Touch Payroll utilisers

-Technology savvy

-Not time wasters

-Excellent communicators

Could you send a love note to a small business today?

Gibberish Day

When it comes to numbers, its all gibberish to me?

Do your bookkeeper or accountant use technical jargon that you don’t understand?

Just wanna chat about your business in plain english?

We like to use everyday terms, something everyone understands.

If you’re looking for a conversation in your language – call us!

Preparedness Month

Just like a scout, are you prepared for anything?

The past few years have shown us that anything can happen – expect the unexpected!

How do you prepare your small business for the unexpected?

What do you keep in your rucksack for emergencies?

Boss/Employee Exchange Day – Tanda & XeroMe

There’s more to it than exchanging labour for wages.

Confidentiality in the partnership is a big concern.

It is not best practice to send any sensitive info by email – we don’t want anyone’s identity to be compromised if any part of the email chain gets hacked.

Sing out if you have any questions about how we can help you keep your employees top secret info safe.

FOLLOW US

to keep up with the news

Subscribe to our Newsletter

Be the first to know about critical dates and important gossip!